June 16, 2011 — Johnson & Johnson subsidiary Cordis International announced Wednesday that it will cease production of the Cypher sirolimus-eluting stent, the first drug-eluting stent (DES) to secure U.S. Food and Drug Administration (FDA) approval, by the end of 2011. The company will also halt production of the Cypher Select Plus as well as development of the Nevo sirolimus DES.

"Due to evolving market dynamics in the drug-eluting stent (DES) business, we see greater opportunities to benefit patients and grow our business in other areas of the cardiovascular device market," said Seth Fischer, company group chair and worldwide chairman, Cordis Corp.

Cordis cited evolving market dynamics as the primary reason for the decision. These dynamics in the DES market include changes in demand, pricing, reimbursement and regulatory requirements for new technologies. The company was the first to introduce a drug-eluting stent, the Cypher, and was the market leader for several years. However, competition from newer generation drug-eluting stents introduced by Boston Scientific, Abbott and Medtronic knocked Cordis out of the top position several years ago and the company has not introduced new DES to reclaim market share.

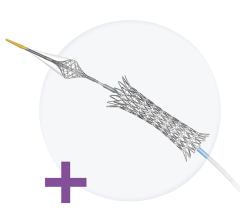

The company was developing the Nevo stent with an innovative drug polymer loaded into holes in the stent struts in an effort to limit the polymer contact with the vessel wall to help prevent neointimal hyperplasia. Recently, bioresorbable polymers and entirely bioresorbable stents have taken center stage in DES development and appear likely to take over the DES market in the coming years. This change in market direction may have played a role in Cordis' decision to exit the stent market.

The company also claims unlicensed competition from products that infringe Cordis patents, both owned and licensed, has eroded Cypher stent pricing, sales and market share, and has dampened the prospects for Nevo stent commercialization.

The company is scheduled to close plants in Cashel, Ireland where Nevo was to be produced, as well as their Cypher manufacturing plant in San German, Puerto Rico. The company will also consolidate its research and development project teams in Fremont, Calif. In total, the company esimates 900-1,000 positions will be cut.

Cordis will continue its commitment to cardiovascular care and shift focus to expanding its range of vascular solutions for endovascular and cardiology procedures. The company will continue to focus on cardiovascular care through its Biosense Webster and Cordis businesses.

Biosense Webster will continue to build and expand on its global leadership position in the $2.5 billion electrophysiology (EP) market, as an innovative provider of advanced cardiac diagnostic, therapeutic, and mapping tools. As the leader in EP navigation systems and ablation therapy, Biosense Webster has technology that includes the largest installed base of cardiac mapping navigation systems worldwide in leading hospitals and teaching institutions and a robust product pipeline.

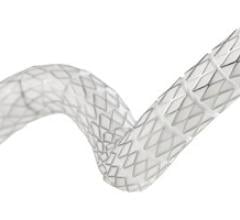

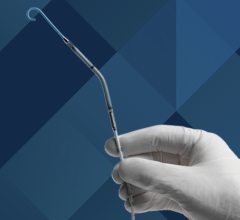

Cordis will expand its portfolio of vascular solutions for endovascular and cardiology procedures, a $12 billion market. The business will focus on access, diagnostic and therapeutic products for cardiology procedures, products to diagnose, access and treat lower extremity disease, and the Incraft stent-graft system, the company's new investigational device for treating abdominal aortic aneurysm (AAA). The company also recently received FDA approval for the Exoseal vascular closure device.

For more information: www.jnj.com

November 24, 2025

November 24, 2025