September 28, 2012 — The world’s first drug-eluting bioabsorbable vascular scaffold has been launched and will revolutionize the stent industry. On Sept. 25, 2012, Abbott announced the launch of its drug-eluting bioabsorbable stent, Absorb, in Europe, the Middle East and parts of Asia Pacific and Latin America. Absorb, which received CE mark certification in 2011, is used to treat coronary artery disease. Bioabsorbable stents, such as Absorb, will broaden treatment and diagnostic options, reduce the need for long-term anti-platelet therapy and reduce the risk of in-stent restenosis and thrombosis.

Coronary artery disease is a progressive condition, characterized by stenosis and occlusion of the coronary arteries. The prevalence of coronary artery disease is increasing worldwide and can be attributed to the growing aging population and risk factors such as diabetes and hypertension. There is a continuous need for better treatment options and expansion of access to therapies among underserved populations.

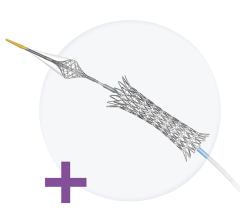

Absorb is designed to open blocked coronary arteries and restore blood flow to the heart. The stent consists of a biodegradable polymer backbone composed of PLLA (poly-L-lactic acid) with a PDLLA (poly-D,L-lactide) bioabsorbable polymer coating that controls the release of the anti-proliferative drug, everolimus. It provides transient support to the vessel wall to prevent recoil and is absorbed by the body over a period of two years. As the stent is absorbed overtime, it relieves patients of a permanent metallic fixture and has the potential to allow the healed vessel to function normally and respond to stimuli. Clinical outcomes have indicated that Absorb performs similar to best-in-class drug-eluting stents across measures such as major adverse cardiac events and target lesion revascularization, with the added benefit of disappearing over time. Absorb is currently in trials in the United States and does not have regulatory approval.

Since their launch in 2003, drug-eluting stents have been adopted worldwide. Several clinical trials have demonstrated that drug-eluting stents can significantly improve clinical outcomes compared to bare metal stents and balloon angioplasty. However, there are several complications with drug-eluting stents such as late-stent thrombosis, need for long-term anti-platelet therapy and incompatibility with imaging modalities. These unmet needs have been addressed with the development of bioabsorbable stents, such as Absorb. The potential long-term benefits of a degradable stent system are significant, making it attractive to physicians and patients. Future interventions can be performed effectively without any obstruction by a permanent implant.

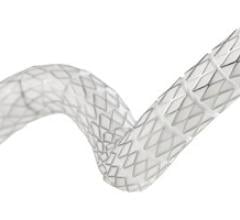

Prior to Absorb making its debut, the Igaki-Tamai (Remedy), developed by Kyoto Medical Planning, was the first bioabsorbable stent commercially available in Europe and Turkey. The Igaki-Tamai stent, a non-drug eluting bioabsorbable stent composed of PLLA polymer, was originally developed to treat coronary artery disease. However, due to unfavorable clinical trial outcomes, the focus was shifted to peripheral use. Recently, long-term clinical outcomes demonstrating the safety and efficacy of the Igaki-Tamai stent for coronary artery disease were published, prompting Kyoto Medical Planning to review its use in coronary applications. The company is expected to apply for CE mark and U.S. Food and Drug Administration approval in the next two years. Another company, Biotronik, is also developing drug-eluting bioabsorbable metal stents (DREAMS) that provide greater radial strength to the vessel than polymer-based bioabsorbable stents and are hypo-thrombogenic.

With the commercial international launch of Absorb, the competitive landscape of the stent market has changed. Adoption of Absorb will vary across regions, depending on the economic status, patient or physician preference and availability of medical reimbursement and marketing in the country. As more long-term clinical data becomes available over the next few years, GlobalData believes the use of bioabsorbable stents will increase compared to drug-eluting stents. Stent manufacturers such as Boston Scientific and Medtronic should expect to see a loss of market share. Bioabsorbable stents are the new wave of stents and are here to stay.

For more information: www.globaldata.com/ExpertsInsightDetails.aspx?PRID=396&companyID=jpr

November 24, 2025

November 24, 2025