April 15, 2012, will mark the 10th anniversary of the approval of the first drug-eluting stent (DES). Ten years ago, the mood surrounding the new anti-restinotic silver bullet stent was one of jubilance. The approval of the new drug-eluting stent completely revolutionized coronary stenting. Ten years later, the first company to win approval for a DES, ironically, has become one of the first to leave the product behind.

Much has happened in the decade since the approval of DES. For starters, there was the emergence of dozens of paclitaxel stents because companies could not effectively market sirolimus stents. That was followed by the market moving away from paclitaxel and globally adopting limus-based drugs as the preferred therapeutic coating. Consequently, that move left several stent companies high and dry.

Companies developing dedicated coronary stent systems for use in a range of applications from acute myocardial infarctions (AMI) to bifurcations fell casualty to the waning interest in dedicated technologies.

Currently, the hot topic in coronary stenting is fully absorbable stents (FAS). Yet, stent experts are divided in their opinions about the utility of these stents in everyday practice. Many experts are skeptical about the usefulness of FAS compared with second- and third-generation DES, and whether they will ever become part of mainstream treatment of coronary disease. If history is a predictor, the question everyone should be asking is: Are FAS another stent fad?

The Impact Of Cordis Leaving the Market

Cordis (a Johnson & Johnson company), having been first in and first out of the coronary stent business, will not have a lasting impact on coronary stenting. After nearly 20 years in the stent business, J&J called it quits. Its exit from the coronary stent market was, by many accounts, unexpected. But some say the company made the right decision in the end. Many ultimately believed the company failed or was unwilling to adapt. Others cited Cordis’ failure to listen to its customers or make moves to improve its stent platform as the cause of the company’s stagnation in the market.

On the other hand, some industry sources believe J&J made a good move exiting the market when it did, and stent users do not seem to be too distressed about the exit either. Many stent users have followed the mantra that while Cordis may have been first to market with coronary stents, other companies improved them. Some industry sources further concluded that the company fell behind and wasn’t able to keep up with what its competitors were bringing to market. As a result, consistent reports of lost market share and revenue over the years, due to eroding stent prices as new stents were approved, compounded things for J&J. In 2011, analysts estimated Cordis’ annual stent sales could fall to $300 million – a mere half of what it had generated the previous year.

The once-lucrative DES market with its billion-dollar potential attracted a lot of new companies to the stent business. Initially, there was the approval of the Boston Scientific, Medtronic and Guidant DES. Then there were Abbott’s actions to obtain market share outside the United States after the company acquired Guidant’s vascular business. This caused the ensuing price and “stent wars,” and deflated stent prices in major markets such as Europe. Although end-users benefited from these price drops, the price competition hindered the ability of new companies to introduce potentially better stent technologies.

Ultimately, the smaller/newer stent companies lost out in the ever-changing market, as prices per unit continued to drop year-over-year, and local health authorities further tightened purse strings. It became abundantly clear that gone were the days of selling a newly approved stent at a premium, based on RAVEL-like data. As a result, new companies, even those with innovative stent platforms, struggled and were unable to break into many key markets, such as Europe – the proving ground for new stents.

Bioresorbable Stents the Next Trend?

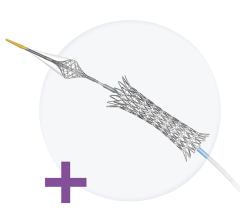

Although in concept FAS have desirable characteristics, such as the ability to dissolve, reduce the risk of long-term stent thrombosis and eliminate the need for long-term dual antiplatelet therapy, experts have signaled their misgivings for FAS, such as Abbott’s new Absorb stent, which takes up to four years to fully dissolve. Renu Vermani, M.D., expressed concern that FAS do not seem to provide much, if any, additional advantage over current second- and third-generation stents, with respect to deliverability, utility and clinical data.

Even though FAS represent the next logical step forward in coronary stenting, they also take several steps back in design and deliverability. Several opinion leaders have suggested that current-generation FAS are too limited in treatment scope and lack the strength and usability of conventional stent products. They question whether these new stents, which are made of either plastic or metallic alloys, will ever have the same handling and performance characteristics as conventional coronary stents.

Others have proposed niche applications for FAS, possibly to treat moderate lesions – those lesions that may not be angiographically significant, but may be vulnerable beneath the surface. However, this is not the first time this kind of idea has been floated for using new stent technologies in a preventative way in order to treat vulnerable lesions or plaques.

Years ago, some industry leaders believed nitinol stents could be used in this way. The rationale was that the self-expanding (SE) nature of a low radial force nitinol stent could be used in the treatment of moderate, non-obstructive, yet potentially vulnerable lesions. To many, the idea of using nitinol for this niche application for treating lesions that may or may not need to be treated never really caught on. Unlike SE stents, FAS need to be deployed at higher pressure in order to ensure good vessel apposition, which could cause more injury than necessary in softer, less occlusive lesions.

Abbott definitely has a jump on other companies developing FAS. Its plan to start a large randomized trial against its own market-leading DES platform – the Xience Prime – could set a benchmark which other FAS companies will need to meet or exceed. For their part, new entrants into the FAS space will need to demonstrate noninferiority against Abbott’s Absorb. According to one expert with close ties to the Abbott FAS program, companies developing FAS only have a small window of opportunity to “get it right.” The challenge is developing a resorbable stent that provides sufficient support without causing a significant inflammatory response. So far, companies such as Biotronik and REVA, both of which have invested heavily in FAS programs, have come up short in terms of presenting compelling follow-up clinical data.

What Does the Future Hold for Coronary Stenting?

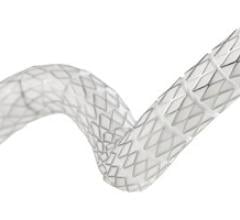

The dynamic of the market will change again as Biosensors and Biotronik start playing a bigger role in the stent business in Europe by filling the gap left behind by J&J. Already, many European physicians are singing the praises of Biotronik’s new sirolimus-eluting stent system. It is predicted, however, that Abbott will remain the preferred choice of users. Abbott’s Xience is currently the most widely used and accepted DES on the market. Medtronic and Boston Scientific will likely battle it out for the second and third spots in the U.S. market, as Boston Scientific recently received FDA approval for its new DES and Medtronic imminently awaits its.

Newcomers be warned: All new stent companies trying to break into the DES space will need to bring something extraordinarily new to the table. In Europe, new companies will have to come directly to market with a DES if they want their product to be considered.

Companies will need resources and patience. They must be prepared to invest 12 to 24 months to prove the feasibility and performance of their technology. New companies can no longer think they can sway end-user loyalty or opinion solely based on a having a “new technology.” End-users will be hesitant to switch to new products unless the products come with sufficient clinical data that can at least demonstrate noninferiority to current second- and third-generation DES.

Dedicated stents, which include those for bifurcations, AMI, self-expanding, etc., will face an uphill struggle if they are marketed without a drug. Ultimately, users want dedicated devices that are easy to use in a DES form. Stent companies, such as Biosensors, which offer a variety of stent platforms with a proven drug and coating process, stand to gain the most in the specialty stent market. Within the last two years, Biosensors acquired the assets of both Cardiomind and Devax, and is in a position to develop and introduce dedicated DES technologies to fill gaps in the specialty stent market, such as bifurcation stenting.

Abbott has the steady lead in the FAS market. Physicians who have used the device say they like it, but conversely say that its scope for use is extremely limited. Data on Abbott’s FAS, presented in 2011, has been promising so far. Proponents of the Abbott system, such as Patrick Serruys, M.D., have said that this first-generation DES FAS is equivalent to the performance of an “excellent” bare metal stent (BMS).

The question is whether the market really needs another excellent BMS when it already has excellent DES? The answer will only be revealed with time.

November 24, 2025

November 24, 2025