There have been several key news items from the U.S. stent market over the past year. These include the introduction of several new stents, Cordis pulling out of the market, an expanded indication in carotid stenting and development of new stent technology that will likely open a new chapter for percutaneous interventions.

In June 2011, Cordis Corp. announced it was pulling out of the stent market to focus on other cardiovascular device areas. It dominated the market nearly a decade ago when it released the first drug-eluting stent (DES) – the Cypher sirolimus-eluting coronary stent. Competition from newer, thinner, better-performing stents eroded Cypher’s market share. The company also said the cost today of bringing new technologies to market outweighs the returns, so it was ending development of its next-generation Nevo stent.

New Coronary Stents

Medtronic’s next-generation stent is the Resolute Integrity zotarolimus-eluting stent, which launched in Europe in August 2010. The bare metal Integrity stent gained U.S. Food and Drug Administration (FDA) clearance in September 2010. The platform uses a single, continuous wire instead of a laser-cut tube.

The use of a single wire may allow anti-proliferative drugs to be loaded inside a hollow wire core, which could be drawn out from small holes using osmotic forces, said Ian Meredith, executive director of the Monash Cardiovascular Research Centre in Victoria, Australia, during TCT 2010. He said this would allow for metal drug-eluting stents that do not use any polymer – the suspected cause of late-stent thrombosis.

The Resolute DES is currently in U.S. trials and one-year results were presented at ACC 2010 by Martin Leon, M.D., associate director of the Center for Interventional Vascular Therapy and professor of medicine at Columbia University/New York Presbyterian Hospital. Out of 1,112 patients who received the Resolute stent, only two cases of stent thrombosis were reported.

“This is one of the lowest stent thrombosis rates we have ever seen in a drug-eluting stent trial,” Leon said.

The stent’s rate of target lesion failure (TLF) at 12 months was 3.7 percent, compared with 6.5 percent for the historical control patients who received the Endeavor stent.

“I think Resolute would be the preferred choice,” Leon said, based on the one-year data. “But, we don’t have the long-term follow-up as we do with the Endeavor. However, I feel most patients would be getting the Resolute stent.”

Resolute uses a new biocompatible polymer to hold the zotarolimus, which allows for an extended drug release across six months.

Medtronic hopes to submit data for final FDA review of the Resolute Integrity DES by early 2012.

Boston Scientific’s next-generation Element stent platform uses a platinum chromium alloy to achieve a thin-strut design that is highly radiopaque, flexible and has less recoil. In Europe, Boston Scientific released the Promus Element everolimus-eluting stent in late 2009 and its paclitaxel-eluting Taxus Element in May 2010.

In June 2010, Boston Scientific began its U.S. launch of the Taxus Element, branded as the Ion in the United States. The new platform is credited with improved patient outcomes over the previous generation Taxus Liberté. The company anticipates FDA approval for the Promus Element by mid-2012.

Boston Scientific is also developing its fourth-generation Synergy coronary stent, which uses a bioabsorbable drug-eluting polymer. Patient enrollment in its overseas clinical trial concluded in January 2011.

Abbott’s Multi-Link 8 bare metal stent is the platform for its next-generation everolimus-eluting Xience Prime stent. Both stents are available in Europe, and the company hopes for a U.S. launch by mid-2012.

New Peripheral Stents

Cook Medical’s Zilver PTX paclitaxel-coated, self-expanding superficial femoral artery (SFA) stent is pending FDA clearance. It will likely become the first drug-eluting, self-expanding stent for use in the legs. It is anticipated to greatly improve stenting outcomes in these vessels, which are very prone to restenosis.

Another advantage of the Zilver over previous DES is that it does not use polymer to retain and control drug elution. Instead, the drug is applied with a special lipophilic coating. It is immediately absorbed after the stent contacts the vessel wall, when it is deployed from a sheath. If approved, it will be the first DES cleared in the U.S. that does not use a drug-carrying polymer.

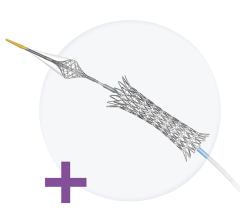

In July, IDEV Technologies said it completed enrollment of 258 patients in the SUPERB trial, an FDA-approved investigational device exemption (IDE) trial evaluating the Supera stent system to treat peripheral artery disease (PAD) in the superficial femoral artery (SFA). The stent, also known as the Supera Veritas transhepatic biliary system, currently has 510(k) clearance in the United States for the treatment of biliary strictures produced by malignant neoplasms. The SUPERB trial results will be used to support IDEV’s pre-market approval (PMA) submission for an additional peripheral vascular indication.

Developments in Carotid Stenting

In May, the FDA cleared the use of Abbott’s RX Acculink carotid stent system to treat standard-risk surgical patients. Prior to this approval, carotid stenting was only indicated for use in high-risk surgical patients who were often denied the standard-of-care, carotid endarterectomy surgery.

The FDA expanded the stent’s indications based on the results of the CREST (Carotid Revascularization Endarterectomy vs. Stenting Trial) study. The 10-year CREST study included 2,502 patients at 119 clinical sites in the United States and Canada. Patients were treated and followed for at least one year. The National Institutes of Health helped fund the study, which found that patients treated with RX Acculink had a similar combined rate of death, stroke and myocardial infarction as those who underwent surgery.

“The CREST data demonstrated that carotid artery stenting is a safe, effective and minimally invasive treatment for standard-risk patients with carotid artery disease,” said L.N. Hopkins, M.D., professor and chairman, department of neurosurgery, and professor of radiology, State University of New York at Buffalo. “With this broader indication, the RX Acculink carotid stent system will become an important option for physicians as they determine the most appropriate treatment approach for their patients.”

Renal Stenting

In July, the FDA cleared Abbott Vascular’s RX Herculink Elite Renal Stent System, the third FDA-indicated stent for renal arteries. In May, Cook began its U.S. launch of its Formula renal artery stent, available in both over-the-wire or rapid exchange delivery systems. Boston Scientific’s Express SD was cleared in 2008.

In recent years, the European STAR and ASTRAL trials showed negative outcomes with renal stenting, causing referrals to drop off. However, many critics say these trials were badly flawed and the operators were very inexperienced. An ongoing study designed to overcome the issues with the earlier trials is expected to answer the question of stent efficacy and safety in patients with advanced renal stenosis. The Cardiovascular Outcomes in Renal Atherosclerotic Lesions (CORAL) study began in 2004. Its completion is expected in early 2014, with preliminary results expected in the fall of 2014. Positive outcomes in that trial will likely boost renal stenting volume.

Bioresorbable Stents

In January, Europe cleared the world’s first bioresorbable stent – Abbott’s everolimus-eluting Absorb. The balloon-expandable stent is made entirely of a polylactic acid polymer. It completely breaks down into carbon dioxide and water within two years, restoring the vessel’s natural function. Results from the ABSORB clinical trial are very promising and have led to optimism at cardiology symposia over the past year that bioresorbable stents may eventually replace metallic stents.

Ron Waksman, M.D., FACC, associate director for the division of cardiology at Washington Hospital Center, Washington, D.C., presented a session on bioresorbable stents at ACC 2011. In comparing the major cardiac and cerebral events related to the Xience V and the Absorb, both had similar results at first. However, adverse events steadily rose for patients who received a Xience V out to 14 months. The Absorb’s adverse event rate plateaued early on and remained nearly level. If that positive trend continues, Waksman said bioresorbable stents will face a bright future.

“In 10 years, we may look back and laugh at the time when we used to leave behind little pieces of metal in patients’ vessels,” Waksman predicted.

Charles Simonton, Abbott Vascular’s chief medical officer, said the company hopes to launch its U.S. Absorb clinical trial in early 2012.

Comparison Chart

This story is an introduction for a comparison on various types of vascular stents. To view the chart, click on the comparison Chart tab at the top of the screen. Participants include:

• Abbott Vascular

• Bard Peripheral Vascular

• Boston Scientific

• Cook Medical

• Medtronic

November 24, 2025

November 24, 2025