September 25, 2007 - Abbott Laboratories said it is working with the FDA Administration to schedule an advisory panel review Nov. 29, 2007, for the company’s Xience drug-coated stent heart device.

Any panel recommendations and follow-up decision from the FDA would also cover the Promus coated stent made by Boston Scientific Corp. because Promus and Xience are the same device, but are sold under different labels. Boston Scientific shares Promus profit with Abbott through an agreement reached last year when the two companies bought parts of Guidant Corp.

The scheduling of the FDA panel review will depend on the availability of panel members, which Abbott expects to be confirmed in the next few weeks, Abbott spokeswoman Kelly Morrison said. Abbott disclosed earlier this month that the FDA planned to schedule an outside panel of experts to review the Xience device, but did not know the timing.

The FDA often uses advisory panels to vet new products, and often follows the panels' recommendations. The agency’s Web site currently shows proposed meeting dates on Nov. 29 and Nov. 30 for its Circulatory System Devices Panel.

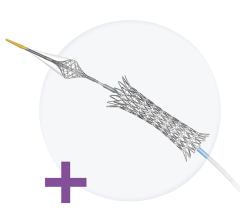

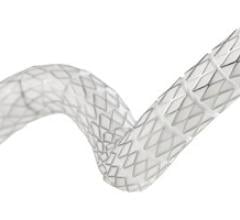

Stents are tiny mesh tubes that prop open heart arteries, and coated devices such as Xience use medication to combat renarrowing. Xience is on sale internationally after launching last fall, and Abbott hopes to bring the device to the nearly $3 billion U.S. coated-stent market in the first half of 2008.

The U.S. market thus far includes devices from Boston Scientific and Johnson & Johnson), and hasn't seen a new coated stent approved in more than three years. But new devices could arrive soon, including the Abbott device and the Endeavor coated stent made by Medtronic Inc.

Medtronic hopes to win Endeavor approval in the U.S. by the end of this year. Endeavor will go before an FDA advisory panel on Oct. 10.

In a note to investors Monday, Morgan Stanley analyst Glenn Reicin called the potential Nov. 29 panel date "a clear positive for Abbott, in our view, as it secures the company's guidance" for a U.S. launch in the first half of next year. The news should also put to rest investor fears that the FDA might require longer-term follow up data on Xience, Reicin said.

He called the news a negative for Medtronic, which now appears to have a short lead on Abbott on the FDA panel schedule. The Xience panel is a mixed bag for Boston Scientific, Reicin said. Boston Scientific has access to the Abbott stent platform through Promus, but its efforts to launch a next-generation coated stent in the U.S. from its own platform remain delayed by an FDA corporate warning letter linked to regulatory problems at multiple company facilities.

The FDA can hold back on new device approvals until warning letter issues are resolved. Paul LaViolette, Boston Scientific's chief operating officer, said at a financial conference earlier this month that the company doesn't expect the warning letter to be lifted by the end of this year.

The coated-stent market has been bruised over the last year by device safety concerns and questions about whether stent procedures are needed for certain stable patients. Such issues have taken a big toll on the market leaders. J&J's coated stents posted $450 million in overall sales in the second quarter, down about 35 percent from a year earlier. Boston Scientific's coated-stent sales fell 32.5 percent in the quarter to $437 million.

Despite these troubles, the coated-stent market still represents a big opportunity for newcomers. Thomas C. Freyman, Abbott's chief financial officer, said recently that the company has a mid- to upper-20 percent market share goal for Xience, and that this is the "baseline" assumption for the U.S. market in 2008. Freyman spoke at a financial conference on Sept. 11, where he also noted the FDA's plans to hold a Xience panel review.

Despite the potential panel review news, shares of Abbott were recently down 1 percent to $53.88. Shares of Boston Scientific were up 2.6 percent to $14.11, and Medtronic shares were up 0.6 percent to $56.88.

Morgan Stanley owns 1 percent or more of Abbott and Boston Scientific common equity securities. The firm has had an investment banking relationship with Abbott and Medtronic.

Source: Chicago Tribune

For more information: www.abbott.com

November 24, 2025

November 24, 2025