December 16, 2011 — A new report from market research firm IMV Medical Information Division reveals the growth rate for interventional procedures being performed in U.S. angiography labs has fallen to 1 percent annually. Fewer sites are buying brand-new systems, and in coming years hospitals most likely will focus on replacing existing systems.

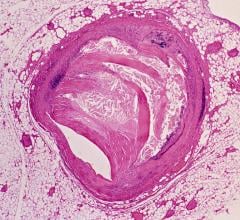

According to IMV’s recent census of angio labs in the United States, an estimated 4.9 million procedures were performed at 1,710 angio lab sites in 2010; this includes noncoronary vascular angiographic and other procedures. From 2008 to 2010, total procedures performed in angio labs grew approximately 2 percent, from 4.8 million to 4.9 million, for hospitals with 150 or more beds. This resulted in an average annual growth rate of about 1 percent.

The pace of angio lab procedure growth has slowed compared with the prior four-year period from 2004 to 2008. In that span, total procedures grew at an average annual growth rate of approximately 4.6 percent, from 4 to 4.8 million.

“While the total angio lab procedure volume has been relatively stable, the procedure mix has broadened,” observed Lorna Young, senior director, market research. “From 2004 to 2010, the number of peripherally inserted central catheter line/vascular access, vertebroplasty, sacroplasty, kyphoplasty, biopsy, radiofrequency (RF) tumor ablation, and other RF studies has contributed to the overall volume of procedures performed in angio labs.”

Young said the market outlook for the next two to three years looks relatively stable, as hospitals seek to retool their older angio labs.

"About 40 percent of the hospitals with 150 or more beds are planning to purchase labs from 2011 through 2013, with more than 90 percent of the planned angio lab purchases having flat-panel digital detectors," Young said. "This is comparable to the 41 percent of angio lab sites reported in IMV’s prior 2008/2009 study.”

IMV's 2011 Interventional Angiography Lab Market Summary Report describes trends in procedures, angio lab X-ray systems, contrast media utilization, power injectors for angio contrast, capital and contrast media budgets, and site operations characteristics. The report also includes market forecast scenarios for 2011-2015, incorporating varying assumptions about the first-buyer, replacement, and additional unit purchases that are based on market indicators identified in the report.

Other report highlights:

· 52 percent of angio lab sites have one room, 31 percent have two rooms, and 17 percent have three or more rooms.

· About three-quarters of planned purchases are for replacement units, and one-quarter will be additional units.

· Angio lab sales in the future will primarily consist of new units, with 98 percent of the planned units being new and 2 percent to be refurbished/used units.

· In addition to interventional radiologists using the angio suite, vascular surgeons are the second most likely physician type to be using angio labs; they performed procedures in more than 60 percent of the angio lab sites.

The firm’s 2011 Interventional Angiography Census Database provides comprehensive profiles of U.S. hospitals with 150 or more beds performing interventional angiography procedures. At least 50 percent of the total lab volume consists of noncoronary angiography procedures. The summary report is available with the database license or as a separate purchase.

For more information: www.imvinfo.com

October 24, 2025

October 24, 2025