This comparison chart features three categories of stents: coronary, carotid and peripheral. We gratefully acknowledge the assistance of Mark Paquin, contributing editor and editorial advisory board member, in drafting specification questions, as well as the manufacturers whose contributions of specs have made this chart a useful tool for physicians.

The article by Frost & Sullivan market analyst Venkat Rajan is a discussion of the DES market and the author's perspectives and forecasts.

The launch of any novel therapy often undergoes a hype cycle in which there is a great deal of interest from market innovators followed by a rise of backlash from specialists who prefer the alternate, more common methods, and ultimately a reconciliation from the two viewpoints. In the case of drug-eluting stents (DES), which initially experienced tremendous growth in the medical device industry, clinical use has slowed recently due to questions concerning the safety of DES. However, manufacturers are confident the next generation of DES will overcome any serious safety issues.

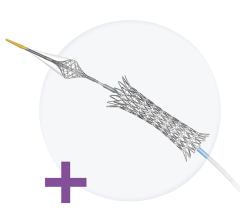

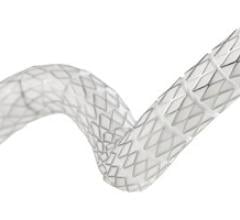

With their hybrid pharmacological coatings and intricate wire mesh design, DES are an elaborate fusion of high-level polymer technologies and specialized device design. These devices can cost several thousands of dollars apiece and it's not uncommon for two or three stents to be used in a single interventional coronary procedure.

While the introduction of most new devices requires a gradual shift from more established procedures, the inherent familiarity specialists had with bare metal stents, coupled with a clinical preference for minimally invasive procedures, accelerated the product growth cycle of DES.

Increasing market maturity and the arrival of several new market entrants over the next few years creates an environment of anticipation among participants and clinicians alike, all eagerly watching for the next major leaps in coronary care.

Sizing up the Competition

Until now the market has been a fiercely contested battle between two medical device juggernauts, both employing strong marketing campaigns effusing the diversity of their product line, ease of implantation or clinical superiority. The next several years will see new product launches from other competitors such as Medtronic, Abbott Vascular and, long term, even a number of niche manufacturers such as Connor Medsystems.

Even market participants Boston Scientific with its TAXUS Liberte and Cordis/J&J with its Cypher Select are developing second generations of their popular devices. Both are expected to improve ease of delivery, implantation and safety.

New market entry and competition are expected to ramp up marketing and increase pricing pressures. It will take three to four years before clinicians determine if certain devices are suited best for specific circumstances.

Abbott's XIENCE V stent received FDA approval in July. It is important to both Abbott and Boston Scientific. When Boston Scientific bought the bulk of Guidant, it struck a deal with Abbott to market the Xience stent under a different name - PROMUS - while sharing profits with Abbott.

Next-Generation DES

Looking past the coated DES, where essentially a drug coating is spray-painted on the inside mesh frame, a number of manufacturers are exploring alternative approaches. One technique has been the use of drug depots - numerous reservoirs that slowly release the drug over time - located throughout a metal stent. The main advantage of such a device would be in ease of implantation.

Other improvements include new types of polymers. A novel hybrid stent material developed by Boston Scientific called platinum enriched stainless steel (PERSE), is engineered to increase radiopacity and strength, while remaining extremely flexible. The new material is used in Boston Scientific's new PROMUS Element and TAXUS Element DES platforms.

Innovative applications are on the horizon for solving some of the biggest industry issues. For instance, Xtent Technologies is developing a methodology for determining stent length insitu, eliminating the need for multiple overlapping devices at risk for thrombosis or stent migration. Clinicians would then be able to deploy stents of the exact size depending on the requirements of that specific occlusion site. Also, polymer technology has advanced to a stage at which completely bioabsorbable devices will soon be plausible.

November 24, 2025

November 24, 2025