Toshiba's Infinix 4D CT, which combines CT with angiography in the interventional lab.

(Editor's note: links to newer information and video links from recent conferences were added to this article in February 2017)

One of the more significant advancements for interventional X-ray (IXR) in the past few years has been an increased focus on core and supporting technologies to provide high-quality, high-resolution images without a corresponding increase in radiation dose.

This has been a key driver behind technology advancements such as Philips’ ClarityIQ technology, Siemens’ Artis Q and Q.zen technology, GE Healthcare’s Image Guided Systems (IGS) and Toshiba’s Infinix Elite product line. GE and Toshiba have moved to a single product line offering, and Philips and Siemens are offering two levels of technology. Philips provides the Allura Xper and AlluraClarity with ClarityIQ technologies. Siemens provides the Artis zee and the Artis Q and Q.zen series.

These solutions integrate new image processing technology and algorithms along with, in some cases, new X-ray tube technology, digital detector technology and other hardware improvements to take advantage of the optimization potential of digital image enhancement.

Monitoring Radiation Dose in the Cath Lab

New technology has been coupled in many cases with dose awareness as well as dose management solutions that allow the operators to monitor dose exposure to the patient both in terms of quantity as well as the levels of exposure to the patient’s skin. Dose exposure has always been tracked for the operators via radiation exposure badges, and this is being enhanced with technologies both from the imaging vendors as well as by third-party solutions such as RaySafe.

The challenge to balance dose with image quality has escalated. As imaging technologies continue to move into advanced therapeutic applications with ongoing growth in stenting technologies, structural heart disease, image-guided applications for surgery and oncology solutions, the need to manage, monitor and control dose exposure while at the same time increasing image quality and resolution has correspondingly grown. These advancements in technology and tools have become increasingly important to apply, but while also understanding and recognizing the critical nature of controlling and limiting dose to the lowest possible levels.

Dose monitoring and educational solutions have become increasingly popular. Philips’ DoseWise, GE’s DoseWatch and Blueprint along with Siemens’ RightDose initiatives are some of these imaging solutions. MD Buyline also has seen an increased interest in third-party solutions such as RaySafe, a real-time dose monitoring solution. All of these solutions are focused on increasing education, awareness and an operator-managed approach to dose management and reduction.

The technology advancements combined with programs focused on dose reduction are a large part of the core imaging improvements over the past three to five years.

Read the article "5 Technologies to Reduce Cath Lab Radiation Exposure."

Market Trends

Based on data from the exclusive MD Buyline database, a clear and steady shift of customers has been seen moving to the advanced image quality and dose management solutions offered by virtually every vendor in this market. Regarding the Philips and Siemens offerings, the Philips AlluraClarity has grown to reflect about 31 percent of quotes seen by MD Buyline.

Siemens’ quotes for the Artis Q and Q.zen solutions represent about 27 percent of the proposals seen. This is in comparison to single or low double digit figures from the prior years.

Generally, these new solutions carry a higher initial capital cost, but vendors have gotten very competitive, and with special programs and promotions they have made the transition to new technology very attractive. Many vendors offer special incentives to entice customers to “upgrade” from older platforms to more dose-efficient systems with improved image resolution and quality.

One angiography manager reported, “Since we installed the more advanced solution, we have seen a noticeable decrease in dose to both staff and the patient. Image quality is as good or better. We have an older system from the same vendor, and our experience has made it an easy decision to upgrade the older lab to the newer platform. Our physicians are very happy with the images and the reduced concern about radiation dose.”

Similar comments from users of other vendor solutions have also been made. There is a debate and vendors have made claims as to who has the lowest dose solution. However, there really is no clear-cut answer. Variability by user, procedure type, procedure length and patient type still have an impact on the results. The newest platforms do deliver on the promise of lower dose with equal or better image quality across a large range of patient body types.

In the general interventional X-ray market, there are a number of vendors. Philips and Siemens are the most commonly considered vendors in this market according to MD Buyline quote activity. There are single plane, biplane and specialty configurations from all vendors that can be considered.

Expanded Applications and Software

In addition to the advancements seen from the vendors, there is also an increasing movement toward specialized software solutions that can expand and enhance specific advanced imaging applications for interventional X-ray solutions.

Electrophysiology (EP) applications

This area of cardiac application requires very precise orientation of specialized catheters that require high-resolution imaging, but can also create quite lengthy procedures. The combination of image orientation and integration of key electrophysiological data being acquired, along with advanced electrical mapping technology, has seen significant benefit in information and how an image shows in a consolidated dashboard type of presentation. Across all vendors, MD Buyline has seen about 5 percent of the deals to be clearly identified with electrophysiology applications. Many of these are biplane solutions, as interventional EP ablations have evolved.

Structural Heart

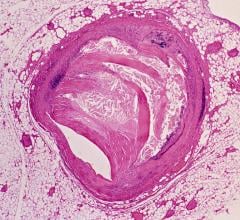

This has been a rapidly growing area spurred by the evolution of catheter-based solutions for treating severe heart valve disease. There is a software solution to assist in combining angiography imaging, ultrasound imaging and in some cases computed tomography (CT) imaging to ensure selection of the replacement valve with proper dimensions and to facilitate deployment in the proper position and orientation. CT may be used prior to interventional to assist in validating the proper size of the valve as well as the general valve orientation with CT-generated 3-D imaging. Three-dimensional 3-D ultrasound using transesophageal echo (TEE) may be used during the procedure for orientation and placement as well as after valve deployment to ensure the valve device is fully deployed. It is also critical to then assess for any residual leaks around the valve (paravalvular leaks). If present, paravalvular leaks can be a significant risk factor in terms of procedure success and long-term patient outcomes.

In terms of structural heart, the market trend has slowed, but it is still reflecting a healthy 16 percent of the deals seen. MD Buyline quote analysis reviews show system configurations with functionality that is targeted to hybrid OR/structural heart applications.

Oncology

MD Buyline has begun to see an interest in oncology applications that assist in image-guided deployment of radiation treatment solutions. We have seen a significant number of proposals that incorporate software designed to assist in oncology-related therapy from most vendors. This is a more recent trend with a quickly increasing interest representing about 7 percent of the activity we have seen. This is up from little to no activity in the previous years.

Neurology

All vendors have continued to improve and expand their 3-D imaging as well as rotational angiography to produce CT-like imaging capabilities. This 3-D capability assists physicians in more advanced diagnostics and therapeutic techniques for stroke diagnosis, evaluation and treatment. Neurology solutions have remained fairly steady representing about 7 percent of the deals we have seen over the past 12 months.

Combining IXR and Ultrasound

There has been an increasing number of proposals that are combining angiography systems with traditional ultrasound units. The applications are primarily focused on the image-guided procedures and structural heart, which are both growing areas within this market. The systems are beginning to incorporate technology that allows images from multiple sources to be displayed on a single large monitor. This is largely part of the oncology area, but it is also part of the hybrid OR/structural heart market since ultrasound is often used both in guidance for oncology applications as well as measurement, guidance and post-procedure evaluation in structural heart.

Interventional X-ray and CT

More interest is being seen in more advanced imaging system combinations, primarily systems that combine interventional X-ray with CT. The most active vendors in this arena are Siemens and Toshiba. The focus is on the growing area of minimally invasive interventional procedures, where imaging and data from both CT and IXR can be useful. The challenge is two-fold: The cost of a combined solution is significant, and you are committing the two systems to a combined solution. While they can be used independently, use of one system precludes the use of the other for a different patient. It is imperative to have the procedure mix that will provide a sufficient patient volume to justify a combined solution. It is a much larger footprint than either solution alone, so it requires an expanded floor plan for installation. Over the past two years there have been less than five proposals for this solution. It is still a very university/research type of application and it will likely be a long time before this type of solution makes its way to the mainstream clinical setting.

The Future of Angiography Advancements

The imaging advancements have changed from historical improvements. I believe the days of vendor and engineering advancements, that are promoted to find a clinical application, are mostly gone. The advancements discussed above largely focus on real clinical issues that needed to be addressed. This is driving the technology and market to be more accountable for the dollars spent and technology acquired as it relates to the value being provided in terms of patient outcome, quality and efficiency of the procedure, and therapeutic treatments. I believe we will continue to see innovation that focuses on tools and solutions that move more therapeutic applications into the minimally invasive and catheter-based solution.

The best example of this is the evolution of structural heart repair such as transcatheter Aortic Valve replacement (TAVR). Manufacturers of valves capable of being delivered via a catheter are now offering a wider array of valve sizes. This expands the patient population that can consider this solution versus surgery. Concurrently, positive clinical experience and studies have shown this is a viable alternative for surgery, which is resulting in the FDA gradually expanding the indication for these devices to less sick patients, expanding its use is more patients. This will continue to spur growth in this market, both from the patient perspective as well as from manufacturers with R&D focused on this minimally or non-surgical approach.

While surgery is still the gold standard and has a long history of clear clinical outcomes, it comes with a much higher price in terms of length of hospitalization, recovery time and related costs. The catheter-based approach provides a clear reduction in these areas.

Oncology treatments seem to be an emerging area too. The vendors and technology have shown they can adapt to focusing on solving clinical needs, which, I believe will continue to be a cornerstone of research and development going forward.

VIDEO: Watch a Shimadzu angiography system demonstration from TCT 2016.

VIDEO: Watch a GE Healthcare angiography imaging demoinstration at RSNA 2016.

Editor’s note: Tom Watson joined MD Buyline in 1986 with over 35 years of experience in the field of cardiovascular medicine. At MD Buyline, Watson is responsible for the area of cardiology, cardiac cath and electrophysiology imaging and monitoring, cardiology PACS and cardiology information systems and a number of other areas. He graduated with a Bachelor of Science degree from Louisiana State University. He received registries in both noninvasive and invasive cardiovascular modalities through the National Society of Cardiopulmonary Technologies as well as adult echocardiography through the American Registry of Diagnostic Medical Sonographers.

October 24, 2025

October 24, 2025