June 30, 2015 - Sunshine Heart Inc. has borrowed an additional $2 million to continue work on its U.S. pivotal study for the C-Pulse Heart Assist System. The minimally invasive surgically implanted device is designed to reduce and potentially reverse heart failure symptoms.

The company announced it has exercised the right to borrow an additional $2 million under its existing loan and security agreement with Silicon Valley Bank. The right to borrow this second tranche was conditioned on the U.S. Food and Drug Administration granting interim analysis of COUNTER HF, Sunshine Heart's U.S. pivotal study for the C-Pulse Heart Assist System, which was obtained in February 2015. COUNTER HF is a prospective, randomized, multi-center, controlled study evaluating the safety and efficacy of the C-Pulse system for the treatment of New York Heart Association (NYHA) Class III and ambulatory Class IV heart failure.

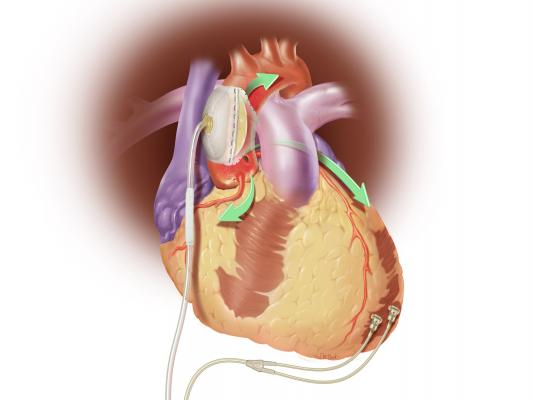

The C-Pulse Heart Assist System is an investigational device in the United States. It utilizes the scientific principles of intra-aortic balloon counter-pulsation applied in an extra-aortic approach to assist the left ventricle by reducing the workload required to pump blood throughout the body, while increasing blood flow to the coronary arteries. Combined, these potential benefits may help sustain the patient's current condition or, in some cases, reverse the heart failure process, thereby potentially preventing the need for later-stage heart failure devices, such as left ventricular assist devices (LVADs), artificial hearts or transplants. It may also provide relief from the symptoms of Class III and ambulatory Class IV heart failure and improve quality of life and cardiac function. Based on the results from our feasibility study, we also believe that some patients treated with our C-Pulse System may be able to stop using the device due to sustained improvement in their conditions as a result of the therapy.

The payment is the second advance under the loan and security agreement entered into with Silicon Valley Bank on Feb. 18, 2015, which provides up to $10 million in growth capital. The first $6 million term loan was funded at the time of closing. Additional details regarding the loan and security agreement are included in a Current Report on Form 8-K filed on Feb. 19, 2015 by Sunshine Heart with the Securities and Exchange Commission.

For more information: www.sunshineheart.com

February 03, 2026

February 03, 2026