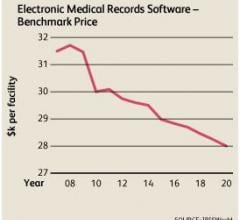

May 20, 2015 — Kalorama Information expects the nearly 25 billion-dollar market for electronic medical records (EMR) to grow well past the period where there are incentives for U.S. healthcare providers, according to a recent report. The healthcare market research publisher said penalties, system upgrades, international sales and continued efficiency improvements will grow the market 7-8 percent each year for the next five years. The market for EMR systems continues to increase as more physicians and hospitals use EMR and acquire EMR systems, and as hospitals and physician groups upgrade existing systems.

"Expect a fair amount of competition and stable growth next few years, without incentives boosting the market" said Bruce Carlson, publisher of Kalorama Information. "Eventually, there will be market saturation but this is a bit of a way off, especially in emerging markets."

Incentives for EMR use are one driver for the market but there is also, starting in 2015, a penalty for not using EMR. There are two components to the American Recovery and Reinvestment Act (ARRA) EMR incentive: One is a positive or 'carrot' to encourage conversion and the second is a 'stick' to discourage paper records over time. Those physicians who do not adopt EMRs by 2015 will face a reduction of 1 percent in their Medicare fee schedule, increasing to a 2 percent reduction in 2016 and a 3 percent reduction in 2017 and beyond. Thanks to the incentive, use has increased among physicians, the group that vendors and the government have been targeting. Initially the market was boosted from incentive payments to physicians as of 2014. Growth rates were impressive in 2012-2014, averaging 16 percent. Growth will continue at approximately 13.4 percent for 2015-2019 as the 'carrot' of incentives tempts physicians but most importantly as the 'stick' of penalties threaten to impact 2015 revenues.

"As we concluded in 2012 and 2013, Kalorama continues to believe that fear of reimbursement loss will end up driving adoption more than incentives for extra reimbursement, and our forecasts continue to reflect this observation," Carlson said.

The report projects continued business for the software and systems sold by companies like Cerner, McKesson, Epic and Allscripts for an electronic medical records purpose. Training and upgrading, optimization and ongoing support will be growth areas for vendors. It is expected that growth will be influenced by consumers either switching their current EMR for a different one or upgrading as technology advances. Kalorama's report said that approximately 80 percent of the work of implementation must be spent on issues of change management, while only 20 percent is spent on technical issues related to the technology itself. Such organizational and social issues include restructuring workflows, dealing with physicians' resistance to change, as well as IT personnel's resistance to design and implementation flexibility needed in the complex healthcare environment.

The report has more information on trends driving the EMR market. It also breaks out the market for various regional markets and for hospital versus physician markets.

For more information: www.kaloramainformation.com

June 14, 2024

June 14, 2024