During a time when the U.S. healthcare reform is on the minds of many within the medical community, physicians and hospital administrators are continuously looking for ways to cut spending. One avenue that physicians and hospitals are exploring is to limit the use of expensive medical devices, such as drug-eluting stents (DES). Moreover, there have been recent concerns of physicians over-stenting in cases where DES are not necessary. These include cases when an alternative treatment option would have been sufficient to treat the lesion, or when the lesion identified through angiography was not actually responsible for the symptoms and did not require an intervention in the first place.

The High Cost of Stents

Use of DES are driving a $2.5 billion coronary stent market in the United States. At a price of about $2,000 for a single DES, limiting the unnecessary implantation of these devices will not only lower costs, but more importantly, will also prevent patients from being exposed to unnecessary risks associated with any type of intervention. Advances in intravascular imaging provide the necessary technology to determine when stent placement is required, the correct size and type of stent, and to ensure that the device is placed correctly in order increase treatment success and prevent repeat procedures.

Issues With Angiography

Traditionally, physicians used X-ray angiography to determine if a patient required an intervention to address plaque build-up and to prevent a heart attack or treat angina. This diagnostic technique was, however, based on the assumption that areas where the vessel greatly narrowed were likely to cause a heart attack. Nevertheless, because the images show a side-view shadow image, it can make a vessel look more occluded than it actually is. This technique can therefore be misleading and cause physicians to improperly diagnose and treat vessels that are not ischemic. Additionally, depending on the viewpoint, occluded arteries may even go undetected during X-ray angiography.

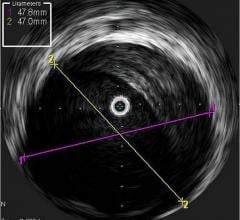

IVUS for Vessel Assessment

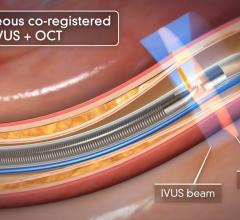

Intravascular ultrasound (IVUS) is another imaging technique that has been available in the United States for more than 20 years. It allows physicians to visualize the lumen diameter and plaque from within the artery, which X-ray angiography is unable to do. IVUS has provided more accurate determination of occluded vessels that require treatment. In addition, IVUS has improved restenosis rates by providing accurate measurements of lumen diameter and plaque area and volume, thereby aiding physicians to implant a stent that is completely apposed to the vessel wall.

Currently, Boston Scientific and Volcano are the only two competitors in the United States that offer IVUS technologies. Boston Scientific offers the iLab Ultrasound Imaging System and the Atlantis SR Pro and iCross Coronary Imaging Catheters. Volcano has several devices on the market and recently received U.S. Food and Drug Administration (FDA) approval for the Eagle Eye Platinum IVUS Digital Catheter in February 2010. It has the advantage of being the only IVUS catheter compatible with small 5 French guides suitable for radial access.

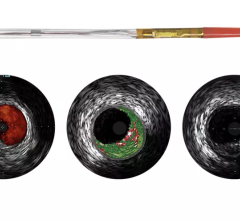

Introduction of OCT Imaging

There are still some skeptics in the medical community who are not completely convinced that the advantages of IVUS over X-ray angiography outweigh the increased cost, procedure time and patient risk associated with IVUS. Nevertheless, some of the lingering concerns will perhaps be addressed by the recent FDA approval of the first optical coherence tomography (OCT) system, which offers a much higher resolution and its ability to more clearly differentiate between vulnerable and nonvulnerable plaques than IVUS.

When a vulnerable plaque ruptures, it often creates blood clots that block blood flow, leading to a heart attack. Because of this, the detection of vulnerable plaques before they rupture has been a major focus of coronary artery disease (CAD) diagnosis. Recently, device manufacturers have been focused on developing new technologies that can identify specific characteristics of a vulnerable plaque, including a thin fibrous cap covering a large lipid core.

In May 2010, St. Jude Medical acquired LightLab Imaging and its C7-XR Imaging System and companion C7 Dragonfly Imaging Catheter. The system became the first OCT system approved in the United States earlier that month. Volcano is expected to launch its OCT device in the United States by mid-2011. St. Jude Medical will likely attempt to equip facilities with its system before Volcano’s product comes to market.

OCT provides real-time tomographic images with a resolution that is significantly higher than IVUS. Although unable to penetrate as deeply into the arterial wall as IVUS, OCT provides clear images, allowing physicians to determine plaque composition and architecture, which helps them in deciding whether the plaque is likely to rupture and requires an intervention. Despite the premium price associated with this technology, OCT will reduce the number of patients undergoing unnecessary procedures to stent nonvulnerable plaques.

Like IVUS, OCT also helps to ensure proper stent placement to limit restenosis and repeat procedures, which helps reduce healthcare expenditures.

High use within a small number of academic centers for research purposes will drive the OCT market through 2015, but its use in a clinical setting may be restricted because of a lack of validation data proving its clinical benefits.

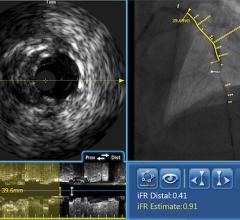

FFR-Guided Therapy

Another technology recently gaining adoption in the United States is fractional flow reserve (FFR). FFR does not technically qualify as an imaging technology, however it can be used in conjunction with IVUS or OCT to determine whether or not physicians should stent an artery. The concept behind FFR is as old as coronary angioplasty, but adoption has only recently expanded due to the results of the FAME trial. That study demonstrated FFR reduces the number of stents used per patient and improves clinical outcomes (at two years, it decreased mortality and myocardial infarction by 34 percent). When X-ray angiography reveals an ambiguous lesion that may or may not be causing symptoms of CAD, FFR helps determine if an artery is ischemic enough to warrant the implantation of a stent. FFR measures pressure differences across an occluded coronary artery to determine the likelihood that the stenosis impedes oxygen delivery to the heart muscle, which can lead to a heart attack. Additional benefits of FFR are that it does not increase procedure time and the overall cost is minimal. In addition, the technology may prevent unnecessary procedures from being performed on patients.

With the recent FDA approval of the first OCT system, St. Jude Medical sits in a comfortable position since it offers a comprehensive diagnostic assessment of CAD with both OCT and FFR systems. Both technologies were gained through acquisitions. Prior to the purchase of LightLab Imaging in 2010, in 2008, St. Jude Medical acquired Radi Medical Systems and its FFR devices, including the PressureWire Certus and the PressureWire Aeris. Volcano is the only other company in the U.S FFR market and its system, which is available on an integrated platform with IVUS, is very convenient for physicians. It will be interesting to see how catheterization labs choose to equip their facilities with advanced imaging techniques in the next year or two as more devices become available on the market.

The entrance of OCT and FFR into the U.S. market over the last two years is changing how physicians diagnose and treat patients with CAD. Improvements in imaging techniques may have initial incremental increases in expenses, but will have long-term benefits in terms of reducing overall procedure expenses and preventing exposure of patients to unnecessary risks associated with interventions.

September 18, 2025

September 18, 2025