Three companies made significant purchases and product introductions in May and June in efforts to gain a larger share of the interventional, cath lab device market.

Combining IVUS, Therapeutic Devices

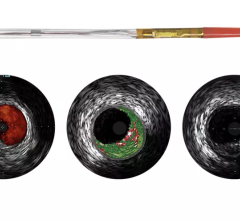

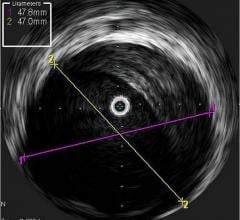

Volcano Corp. told Diagnostic and Invasive Cardiology earlier this year it plans to diversify its business from intravascular imaging systems and fractional flow reserve (FFR) catheters to interventional treatment devices. It received its first therapy device regulatory clearance in Europe for the Vibe RX, a single catheter combining intravascular ultrasound (IVUS) with an angioplasty balloon. The catheter reduces the need for multiple exchanges, helping to speed procedure times and cut costs.

The Vibe RX is the first of what the company hopes will be many image-guided therapy devices. Volcano’s initial focus is on cardiovascular applications, but it will eventually leverage the combo technology for other applications throughout the body.

The company also plans to expand its interventional offerings through partnerships with other device manufacturers. Earlier this year Volcano entered into a Japanese distribution agreement with AngioScore for its AngioSculpt PTCA scoring balloon catheter.

OCT Cleared, Then Purchased

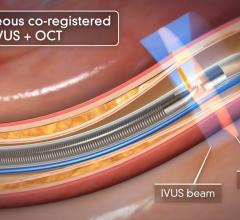

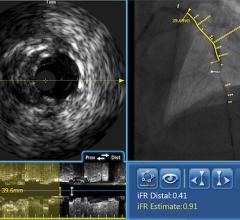

Soon after the U.S. Food and Drug Administration (FDA) cleared LightLab Imaging’s optical coherence tomography (OCT) intravascular imaging system, St. Jude Medical purchased the company. The $90 million purchase will make St. Jude the only company in the United States to offer OCT, which provides image resolution 10 times greater than IVUS. The technology is expected to offer serious competition for IVUS makers Boston Scientific and Volcano.

St. Jude said OCT is expected to bring in an extra $20 million in revenue during the second half of 2010. The company also expects the OCT market to grow at a double-digit, compounded annual rate over the next five years. The IVUS market is estimated to be $500 million for 2010 and is growing 10 to 15 percent annually. St. Jude said the OCT coronary imaging is expected to grow at an even faster rate.

Volcano also developed an OCT system, which gained European clearance in January. The company is now awaiting FDA investigational device exemption (IDE) approval so it can start its U.S. clinical trial. Volcano hopes to release its OCT system in the United States by mid-2011.

Expanding Into the Interventional Market

Covidien Ltd. recently purchased ev3 Inc. for $2.6 billion to expand its percutaneous vascular portfolio. The company said it hopes to become a leading endovascular player in both the peripheral vascular and neurovascular markets.

Ev3 Inc. developed several technologies for the treatment of peripheral vascular and neurovascular diseases. These products include peripheral angioplasty balloons, stents, plaque excision systems, embolic protection devices, liquid embolics, embolization coils, flow diversion, thrombectomy catheters and occlusion balloons.

Last year, Covidien purchased VNUS Medical Technologies and Bacchus Vascular to expand its vascular interventional business. VNUS is a leading provider of medical devices and procedures for the minimally invasive treatment of venous reflux disease. Bacchus Vascular offers the Trellis thrombolysis peripheral infusion system to treat deep vein thrombosis (DVT).

Detailed information on the use of the Trellis device can be found in this issue’s story on clot busting technologies on page 6.

September 18, 2025

September 18, 2025