July 7, 2014 — Thoratec Corp. has acquired Apica Cardiovascular Ltd. for an upfront cash payment of $35 million and potential future clinical and sales milestones of up to $40 million. As part of the agreement, the Apica team based at facilities in Ireland and the United States will transition to Thoratec.

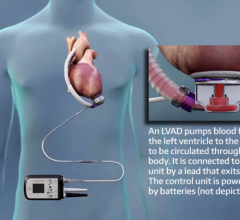

Apica has developed a suite of implant systems and devices designed to enable transapical surgical access. These devices include a VAD Surgical Implant System (SIS) and the Apica Access Stabilization and Closure (ASC) device for use in transcatheter aortic valve replacement (TAVR) and transcatheter mitral valve replacement (TMVR) procedures performed with a transapical approach. The Apica implant systems are meant to enable uniform access to the heart in transapical procedures with minimal interoperative and post-operative blood loss and a secure permanent closure that eliminates the need for sutures. The VAD SIS specifically leverages the proven existing technology foundation of the ASC with the potential to support less invasive and off-pump implantation of HeartMate products while seeking to facilitate reproducible clinical outcomes and wider adoption of these implant techniques.

Thoratec will immediately assume ongoing development and commercialization of the Apica VAD SIS and ASC platforms. The ASC device received CE mark approval in 2013 and is currently in limited commercial launch throughout Europe. The VAD SIS device has achieved important development milestones and Thoratec will continue to develop this technology to optimize its application for VAD implants prior to initiating human clinical trials.

Thoratec anticipates that the acquisition will add incremental operating expenses of approximately $3 million during the remainder of 2014 and $6-7 million in 2015, primarily related to research and development. Additionally, since Apica is an Irish-domiciled entity, Thoratec's tax rate will increase modestly during the developmental phase of the VAD SIS program due to the loss of U.S.-based expense deductions, although the company anticipates meaningful long-term tax benefits from this transaction. Thoratec will also recognize transaction-related expenses, including the amortization of intangible assets, which will be quantified in the company's second and third quarter earnings reports following completion of the purchase price allocation for the transaction.

For more information: www.thoratec.com

June 19, 2024

June 19, 2024