January 17, 2017 — ECRI Institute announced a new mergers and acquisitions service that empowers new hospital alliances to control their spending and plan for the future by eliminating waste and redundancy in medical-surgical supplies and capital medical equipment.

The No. 1 reason hospital mergers or acquisitions do not succeed, according to ECRI Institute, is failure to integrate. A precursor to any successful integration is a systematic review of contract portfolios and equipment inventories.

Unfortunately, many hospitals do not have the resources to perform a complete assessment in these areas — essentially risking millions of dollars in potential savings and inadvertently creating new safety and quality risks.

For supplies, ECRI Institute identifies the greatest opportunities for savings by negotiating to the lowest price available. For example, by analyzing purchase order histories and pricing data for merging organizations, ECRI Institute's price parity reports identified $3.2 million in potential savings for one transaction, and nearly $1.3 million for another.

ECRI experts highlight product categories with significant overlap and compare them to the categories that will require product conversion.

"With supply costs set to eclipse labor costs in just a few years, hospitals can use ECRI Institute's independent benchmarking capabilities and market analytics to negotiate the best pricing and deepest discounts from their suppliers," said Timothy Browne, director of ECRI Institute's PriceGuide service.

For capital equipment, the new service reduces expenditures by helping newly merged health systems develop a data-driven predictive replacement plan for equipment acquisition, replacement and redeployment.

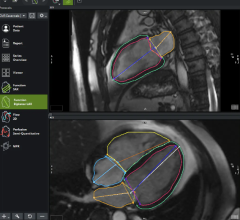

Based on clinical, safety, operational and obsolescence criteria, the plan focuses on maximizing use of existing medical equipment and expanding capital availability in key technology areas such as radiology, surgery and cardiology.

In the case of one hospital system that was preparing to put itself on the market, ECRI Institute uncovered $6.7 million of potential capital savings from the redeployment, replacement and retirement of key technologies over a 12-month period.

For more information: www.ecri.org

November 14, 2025

November 14, 2025