August 25, 2015 — Medtronic announced it entered a definitive agreement to acquire Twelve Inc., a start–up medical device company focused on the development of a transcatheter mitral valve replacement (TMVR) device, for $458 million. Many in the industry see transcatheter heart valves as the next major area for technology expansion in structural heart disease.

Twelve is a privately held medical device company based in Redwood City, Calif. It was the twelfth company spun out from the medical device incubator The Foundry.

"Upon close, this acquisition will strategically augment our existing capabilities in the transcatheter mitral space, which represents an important growth opportunity for Medtronic," said Sean Salmon, senior vice president and president, coronary and structural heart, Medtronic. "We have followed the transcatheter mitral valve space closely and firmly believe that Twelve has the most novel technology along with a strong, proven team. The combined strengths of our organizations will significantly accelerate our ability to deliver an exciting and differentiated therapy to patients, physicians and healthcare systems around the world."

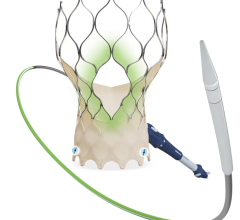

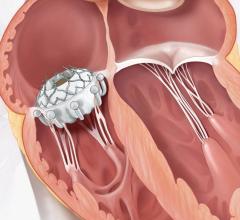

Mitral regurgitation occurs when the heart's mitral valve fails to close normally, allowing blood to flow backward when the heart contracts. Over time, this will lead to declining heart function and heart failure. The TMVR device under development is being designed to treat patients with mitral valve regurgitation in whom standard restorative surgery is not recommended. The majority of these patients are largely underserved with limited treatment options.

"Twelve's technology is a truly creative solution that brings together valve technology with a unique and highly differentiated dual-stent fixation design," said Andrew Cleeland, president and CEO of Twelve. "Our acquisition by Medtronic will create a tremendous opportunity to leverage Medtronic's expertise and proven success in the structural heart space to advance the treatment of mitral regurgitation."

Medtronic has agreed to pay up to $458 million for Twelve including $408 million at closing and $50 million on achievement of European CE mark. The cash and debt-free transaction remains subject to customary closing conditions, and is expected to close in October 2015. The transaction is expected to meet Medtronic's long-term financial metrics. Medtronic expects the net impact from this transaction to be earnings neutral as the company intends to offset the dilutive impact of the transaction. Medtronic will manage the Twelve product line as part of the coronary and structural heart division within the cardiac and vascular group.

"We are keenly focused on improving patient outcomes and expanding access to care for those who need it most," Salmon added. "We believe this acquisition will help deliver on this commitment by enabling Medtronic to bring forward a best-in-class transcatheter mitral valve replacement device with the potential to transform patient care."

In collaboration with leading clinicians, researchers and scientists worldwide, Medtronic offers the broadest range of innovative medical technology for the interventional and surgical treatment of cardiovascular disease and cardiac arrhythmias. The company strives to offer products and services that deliver clinical and economic value to healthcare consumers and providers around the world.

The Twelve’s TMVR device does not have regulatory approval in any country.

For more information: www.medtronic.com

July 08, 2024

July 08, 2024