April 9, 2012 — After witnessing a downtrend for several years, revenues in the U.S. nuclear medicine and positron emission tomography (PET) imaging systems market finally pivoted in 2010. New radiotracers and technologies are expanding the clinical scope and customer base of nuclear medicine and PET imaging. As a result, declines in retrenching areas of the market are poised to be offset by strong growth in emerging end-user market segments. New analysis from Frost & Sullivan's U.S. Nuclear Medicine and PET Imaging Systems Market research finds that the market earned revenues of $552.4 million in 2010 and estimates this figure to reach $841.8 million in 2017.

"The unique ability of nuclear medicine and PET to enable characterization of biological processes at the cellular and molecular levels is bringing increasing attention to these imaging modalities as medicine evolves toward more personalized forms of treatment," said Frost & Sullivan industry analyst Roberto G. Aranibar. "This powerful capability of nuclear medicine and PET will become increasingly relevant as personalized healthcare becomes mainstream practice in modern medicine."

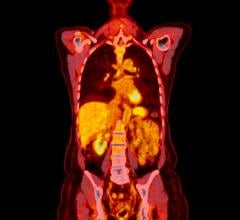

Molecular imaging has been a key enabling factor for treatment that is selected according to a patient's unique disease state. For example, in cancer treatments, numerous chemotherapy options are available, and a patient's response to a particular treatment can vary considerably based on the specific molecular characteristics of the cancer. With molecular imaging, however, clinicians can determine which characteristics are present in a cancer and use this information to make the most appropriate treatment decision on a patient-by-patient basis.

Ongoing challenges surrounding the state of the economy as well as changes in healthcare policy and reimbursement are forcing more private practice physicians and independent imaging centers to opt for affiliation with larger provider organizations. This shift in the healthcare provider landscape has led to rapidly diminishing revenues within the private practice cardiology market, which formerly accounted for a significant proportion of revenues in the more mature and established nuclear medicine segment of the market.

Naturally, the evolving healthcare provider landscape has led to changes in the types of imaging systems demanded in the marketplace. For example, the need for dedicated cardiac scanners appears to be diminishing, as more cardiologists become affiliated with larger institutions that often benefit more from general-purpose scanners with a broader scope of clinical application.

"Nuclear medicine imaging equipment manufacturers that previously offered only dedicated cardiac scanners have reacted to changes in the healthcare provider landscape by further diversifying their product portfolios in order to include clinically versatile, general-purpose gamma camera systems," said Aranibar. "A number of manufacturers have also chosen to focus on other niche, yet emerging, applications of nuclear medicine and PET that involve molecular breast imaging and brain imaging."

For more information: www.frost.com

November 17, 2025

November 17, 2025

![Phase III clinical trial of [18F]flurpiridaz PET diagnostic radiopharmaceutical meets co-primary endpoints for detecting Coronary Artery Disease (CAD)](/sites/default/files/styles/content_feed_medium/public/Screen%20Shot%202022-09-13%20at%203.30.13%20PM.png?itok=2w6OoNd6)