May 6, 2010 – After entered the Japanese drug-eluting stent market earlier this year, Abbott's Xience V and Boston Scientific's Promus stents picked up share from competitors Medtronic and Cordis, according to the market intelligence firm Millennium Research Group (MRG).

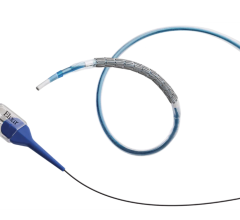

In its peak sales month, Xience V was used in more than 50 percent of drug-eluting stent procedures, and averaged a unit share of just less than 40 percent for the first quarter 2010. Meanwhile, Promus captured approximately one-third of Xience V's unit share during the same time period, despite the fact that the devices are identical and were launched simultaneously.

When Boston Scientific acquired Guidant in 2006, it divested Guidant's cardiovascular businesses to Abbott Vascular. However, under the agreement Boston Scientific can sell a restricted quantity of Guidant's drug-eluting stent, marketed under the Promus brand, for a limited time. In Japan, this agreement ends in June 2012.

"Xience V is out-performing Promus almost three to one in Japan," says Bina Mistry, senior analyst at MRG. "Both devices are identical in clinical safety and efficacy and prices do not vary drastically between the brands.”

She said there are two reasons for this trend. First, because most clinical trials studying this device are predominantly using Xience V, this stent is building up better brand recognition, and in some cases, physicians may even be unaware that the Xience V and Promus are the same device. This phenomenon has occurred in other regions around the world. Second, she said Abbott Vascular has a breadth of successful coronary products, including bare-metal stents and angioplasty balloons, and a strong company image in Japan. “Physicians who prefer the Abbott name may adopt Xience V over Promus," Mistry said.

MRG's Japanese Interventional Cardiology Marketrack gathers data from 110 catheterization labs throughout Japan on a monthly basis. Product categories covered include drug-eluting coronary stents, bare-metal coronary stents, percutaneous transluminal coronary angioplasty (PTCA) balloons, guide wires, guiding catheters, diagnostic catheters, embolic protection devices, intravascular ultrasound (IVUS) catheters, introducer sheaths, atherectomy devices, thrombectomy devices, inflation devices, optical coherence tomography (OCT) devices, and vascular closure devices. MRG also gathers data from the United States, Europe, Asia Pacific, Latin America, and the Middle East. Marketrack subscribers receive thousands of data points, including usage (units, average selling prices, and revenues), procedures, competitor shares, and brand-level information.

For more information: www.MRG.net

July 02, 2024

July 02, 2024