July 25, 2007 - Teleflex Incorporated, a diversified company expanding medical technology business, and Arrow International Inc., a provider of catheter-based access and therapeutic products for critical and cardiac care, announced that they have entered into a definitive agreement pursuant to which Teleflex will acquire Arrow in an all cash transaction valued at approximately $2 billion.

The merger agreement provides for a cash payment of $45.50 per share for each outstanding share of Arrow stock, representing a premium of 20 percent over Arrow's closing share price on July 20, 2007. Through the merger, Teleflex will redefine its portfolio by creating a $1.4 billion medical technology business designed to account for the company’s largest generator of revenues and profitability.

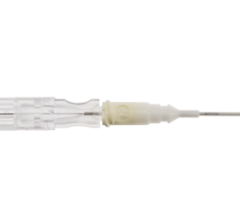

Arrow will add an established position in catheter-based products for critical and cardiac care with many of the most known brands that complement the Teleflex Medical portfolio of disposable medical devices for respiratory care, anesthesia, urology and surgery.

Teleflex expects that with the addition of Arrow, its medical business in fiscal 2008 will achieve annual revenues of approximately $1.5 billion and generate operating margins in the 20 percent range.

For more information: www.arrowintl.com and www.teleflex.com/medical

October 28, 2025

October 28, 2025