The stent market will have a distinctly different look after Johnson & Johnson completes its acquisition of Conor Medsystems, a $1.4 transaction that is expected to close in the first quarter of 2007, J&J reports. The companies announced their definitive agreement late last week.

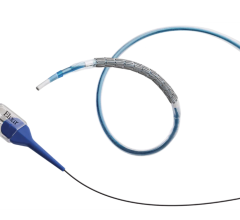

J&J’s acquisition of Conor will provide Cordis Corp. — also owned by J&J — with a unique controlled drug delivery technology that is currently employed on the CoStar Stent System, a paclitaxel-eluting cobalt chromium stent with a bioabsorbable polymer. CoStar is currently sold outside the U.S., but enrollment in its U.S. pivotal clinical trial has been completed. Conor Medsystems will operate as part of the Cordis franchise.

Under the terms of the agreement, an all cash merger transaction, Conor Medsystems' stockholders will receive at closing $33.50 for each outstanding Conor Medsystems share. The $1.3 billion estimated net value of the transaction is based on Conor Medsystem's 42.7 million fully diluted shares outstanding, net of estimated cash on hand at time of closing.

The boards of directors of both companies have approved the transaction, which is subject to clearance under the Hart-Scott-Rodino Antitrust Improvements Act, Conor Medsystems stockholder approval and other customary closing conditions.

July 02, 2024

July 02, 2024