September 12, 2011 — Cardiovascular market research firm Zacks Equity Research released a new report discussing high growth areas in medical devices, including Medtronic Inc., Boston Scientific Corporation, St. Jude Medical, Edwards Lifesciences and Zoll Medical.

The above-listed companies produce life-sustaining products and are less affected by economic turbulence. Some of these companies have been successful in weathering the storm (pricing, currency and volume headwinds) in the cardiovascular space.

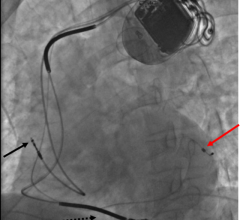

With a spate of new products, the big three players (Medtronic, Boston Scientific and St. Jude) in the $6.5 billion implantable cardioverter defibrillator (ICD) market are well positioned to gain market share; this is despite the challenging business environment and several other barriers to growth. These companies have a number of levers to pull and represent a good bet for long-term investors.

Among the names above, Medtronic has a diversified presence in cardiovascular, neuro, spinal, diabetes and ear, nose and throat (ENT) and boasts an attractive pipeline. Although the company witnessed weakness in its ICD business in the most recent quarter, new products should gradually contribute to growth and help it maintain/gain ICD share.

The long-awaited issue of the U.S. Food and Drug Administration (FDA) warning letters, relating to Medtronic's Mounds View facility and manufacturing unit in Puerto Rico, was finally resolved in March 2011. This paved the way for the United States approval and launch of new products including the much-anticipated Protecta ICD device.

Boston Scientific has maintained its leadership in the drug-eluting stent (DES) market. The company saw all-around growth during the second quarter, outstripping its own guidance, although the cardiac rhythm management (CRM) segment remains challenging. After several quarters, growth in the cardiovascular portfolio came as a pleasant surprise. Based on a strong quarter, the company raised its guidance for 2011. We recently upgraded the stock to “Outperform.”

We remain intrigued by St. Jude's ability to consistently produce positive earnings surprises and revenue growth. The company is poised for incremental opportunities in CRM on the back of strong product momentum. St. Jude's Fortify and Unify devices are already gaining notable traction.

Several new products — including the quadripolar cardiac resynchronization therapy defibrillator (CRT-D) systems — should boost the company's CRM share in 2011, despite weak market conditions. However, we do account for the fact that approval of the quadripolar CRT-D has been pushed back to early fourth quarter 2011 from mid-2011.

Beyond the MedTech giants, Edwards Lifesciences represents another value proposition. The company recorded strong revenue growth in the second quarter, banking on robust performance of its heart valve therapy products. Apart from heart valve therapy, healthy growth at the critical care segment (led by Flotrac systems and pressure monitoring products) is also encouraging.

Moreover, Edwards's robust balance sheet enables it to target suitable acquisitions. Following the favorable recommendation of the FDA Advisory Panel for Sapien THV (for inoperable patients), the company is confident of receiving final approval by October 2011. The United States approval of the device should offer a major boost to the company's sales in the long term.

Another interesting pick in our portfolio is resuscitation devices maker Zoll Medical. Zoll is a leading player in the global market for external defibrillators, which is worth more than $1 billion. The company's LifeVest wearable defibrillator business continues to grow at a healthy quarterly run rate, benefiting from increased awareness of the product and associated sales force enhancements. Moreover, its significant international presence should also push growth.

For more information: http://at.zacks.com/?id=2679

January 13, 2026

January 13, 2026