January 19, 2023 — Shockwave Medical, Inc., a pioneer in the development of Intravascular Lithotripsy (IVL) to treat severely calcified cardiovascular disease, today announced it has entered into a definitive agreement to acquire Neovasc Inc., a company focused on the minimally invasive treatment of refractory angina.

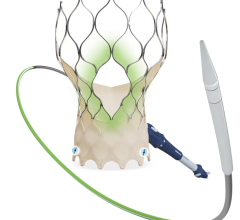

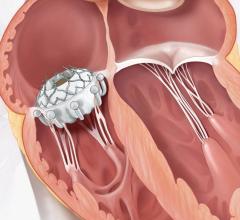

The Neovasc Reducer System is a first-of-its-kind technology to address refractory angina. Refractory angina is a chronic condition in which a patient suffers chest pain that cannot be controlled by conventional therapies. It is estimated that each year, in the U.S. and the E.U. alone, up to 300,000 new patients with obstructive coronary disease who are ineligible for conventional revascularization experience refractory angina, despite guideline-directed medical therapy. In addition, it is estimated that up to another 500,000 new patients present with angina and non-obstructive coronary artery disease (ANOCA) in the U.S. and the E.U. each year. The Neovasc Reducer System has been granted Breakthrough Device designation by the FDA, is CE-marked and is currently enrolling patients in the COSIRA-II study, a randomized clinical trial being conducted under an Investigation Device Exemption intended to support U.S. FDA approval for patients with coronary obstructive refractory angina.

“Refractory angina is a debilitating condition without an effective therapy that impacts millions of patients,” said Gregg W. Stone, MD, FACC, MSCAI, Principal Investigator of COSIRA-II, Director of Academic Affairs for the Mount Sinai Heart Health System, and Professor of Medicine (Cardiology) and of Population Health Sciences and Policy. “The ongoing COSIRA-II randomized trial has been designed to definitively demonstrate that the Reducer is superior to a sham control for these patients, offering the potential to change the lives of these patients who are desperate for a solution for their refractory angina.”

“Our team at Shockwave has proven that we excel at developing products and markets for large, underserved patient populations and commercializing innovative solutions for these patients. We believe the Reducer is an excellent fit for Shockwave as it enables us to apply our capabilities to address another large, unmet need within cardiology – refractory angina,” said Doug Godshall, President and Chief Executive Officer of Shockwave. “The timing is ideal as there will be no distraction to our U.S. sales organization in the near term and, as we did with C2, our coronary device, we expect to refine our commercialization approach and begin the development of international markets in advance of U.S. approval. This transaction supports our commitment to drive growth through innovation and we are excited for the potential to bring even more solutions to our customers and the patients they serve with the Reducer System.”

Terms of the Neovasc Agreement

Upon the closing of the transaction, Shockwave Medical will acquire all outstanding Neovasc shares for an upfront cash payment of $27.25 per share, corresponding to an enterprise value of approximately $100 million, inclusive of certain deal-related costs. Neovasc shareholders will also receive a potential deferred payment in the form of a non-tradable contingent value right (CVR) entitling the holder to receive up to an additional $12 per share in cash if certain regulatory milestones are achieved. The upfront cash consideration represents a premium of 27% and 68% to the closing price and 30-day VWAP, respectively, of Neovasc’s common shares on the Nasdaq Capital Market on January 13, 2023.

The transaction will be effected by way of a court-approved plan of arrangement pursuant to the Canada Business Corporations Act, and is subject to customary closing conditions, including requisite Neovasc shareholder approval. Shockwave expects to complete the transaction in the first half of 2023.

The Board of Directors of Neovasc, acting on the unanimous recommendation of a special committee comprised of independent directors and after having received an opinion from its financial advisor to the effect that the consideration to be received by Neovasc shareholders pursuant to the plan of arrangement is fair from a financial point of view, has unanimously approved the arrangement. Directors and executive officers of Neovasc and related parties, holding an aggregate of approximately 9.23% of the Neovasc shares currently outstanding (on a non-diluted basis) have entered into support and voting agreements with Shockwave.

For more information: www.shockwavemedical.com

Related Content:

Shockwave Medical Initiates All-Female Coronary IVL Study

Transcatheter Cardiovascular Therapeutics (TCT) 2022 Conference Preview

Medtronic Intrepid Transcatheter Mitral Valve Successfully Uses Transfemoral Delivery

July 08, 2024

July 08, 2024