April 9, 2012 — Healthcare supply contracting company Novation released its 2012 Diagnostic Imaging Watch report. Peer reviewed by members of Novation's Diagnostic Imaging Council, the report is an overview of the latest product technology and trends for imaging subspecialties.

The recent economic slump has resulted in weakened sales in capital equipment during the past three years. Despite this, hospitals do appear to be purchasing new equipment and replacing obsolete machines. Buyers are doing so with cautious optimism, however, and are asking tougher questions about clinical utility, workflow and radiation dose.

"The members we serve that manage the procurement of these products should have insight into and understanding of the technology and industry dynamics that will affect their investment decisions in diagnostic imaging," says Mike Clemens, vice president, capital equipment and diagnostic imaging for Novation. "Because Novation is committed to being a source of this information and technology expertise, our staff continuously studies the latest technologies and trends in diagnostic imaging."

The report not only discusses topics such as radiation dose reduction, PET/MRI (positron emission tomography/magnetic resonance imaging) hybrid imaging, digital X-rays, and the emerging use of "cloud" technology, but it also reviews the economics and trends of the latest diagnostic imaging technologies. Highlights include:

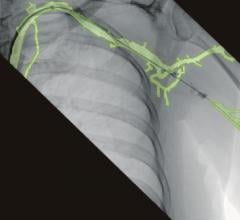

- Angiography/Cardiovascular Suites. Advanced imaging techniques continue to evolve with improvements in image quality, dose reduction techniques and efficiencies in workflow. The cost for a single-plane angiographic system will range between $750,000 and $1.5 million, with bi-plane systems ranging between $1.4 million and $2.8 million, depending on the configuration.

- C-Arms (Surgical and Mini). The mini C-arm market has been growing steadily. These systems are often used in orthopedics, emergency rooms and even physician offices. When doing fluoroscopic imaging of extremities, the mini C-arm is preferred over the standard size C-arm.

- Computed Tomography (CT). Fewer and fewer facilities are purchasing CT scanners with less than 64-slice capability. The exceptional speeds of 64-slice scanners enables detailed tomographic images of the entire body in sub-30-second scan times. Given the rapid pace of this technology, many facilities are faced with the decision of whether to purchase or lease. Facilities should plan to spend between $800,000 and $1.8 million for a 64-slice, and from $1.3 million to more than $3 million for a 160-slice or higher scanner. As with most technologies that experience price erosion based on age, a lower-end CT scanner (32 slice or less) could be purchased for much less.

- Informatics. Information technology suppliers, especially in the PACS (picture archive and communications system) arena, continue to offer both a capital- and fee-per-study purchase model. As an application service provider, suppliers often offer to manage image data and information remotely. The RIS (radiology information system)/PACS markets are saturated, however, and continue to expand their offerings. Managed storage options are becoming more popular, well-refined and cost-effective. Because this is a replacement market, it is important to consider the cost of data conversion, retraining staff, and upgrading or expanding hardware.

- Molecular Imaging – Nuclear Medicine, PET/CT and PET/Mr. Molecular imaging, especially in the cardiac segment, is expected to grow with the continued attention that cardiac disease prevention and treatment is receiving. More and more cardiologists are offering dedicated SPECT (single photon emission CT) units in order to perform cardiac studies in their offices. A single head gamma camera can cost about $200,000, with dual head cameras running closer to $300,000 to $400,000. SPECT/CT systems range from $400,000 to $600,000 on average. In the area of PET/CT, image fusion software continues to be refined and expanded. Many facilities have already replaced their outdated dedicated PET-only models. A PET/CT (64-slice) can easily cost between $2 million and $3 million.

- Women's Imaging Products. Women's imaging products span multiple modalities, including digital radiography, computed radiography, ultrasound, molecular imaging and magnetic resonance imaging. Advancements in technology will continue to move at a fast pace to meet diagnostic and treatment needs in the areas of cardiology, osteoporosis, and breast and colorectal cancers. As new technology is developed, it will likely come with a higher initial price tag. However, existing technology that continues to be improved will tend to experience the same price erosion as others within the same modality family.

In addition to these areas, the report also covers the economic and technological trends of additional modalities including digital radiography, computed radiography, magnetic resonance, power injection systems and ultrasound.

The entire report is accessible at https://www.novationco.com/pressroom/industry_info.

June 20, 2024

June 20, 2024