April 13, 2016 — The global market for contrast media is set to rise from just over $4.3 billion in 2015 to over $6 billion by 2022, according to research and consulting firm GlobalData. This represents a compound annual growth rate of 4.9 percent.

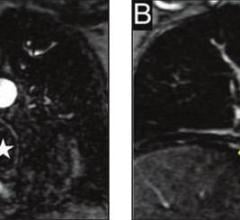

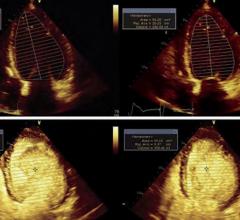

The company’s latest report states that this growth — which will occur across the 10 major markets (10MM) of the United States, France, Germany, Italy, Spain, the United Kingdom, Japan, Brazil, China and India — will be driven by a number of factors. These include increases in the number of annual computed tomography (CT), magnetic resonance imaging (MRI) and echocardiogram procedures as well as an increasing disease burden across the 10MM.

Amendeep Sanghera, GlobalData’s analyst covering medical devices, explained, “The contrast media market is old and well-established, with products being used in a wide array of indications. As populations rise across the global, disease rates inevitably grow, along with the need for diagnostic investigations and therefore contrast media.

“Better healthcare systems and education across numerous regions are also driving the contrast media market. For example, there is a particular focus in developed countries to screen patients for certain diseases such as breast and colorectal cancer in order to catch disease early and increase the likelihood of a patient’s survival, and this practice is now spreading to developing countries.”

GlobalData’s report also states that the market has no real competition besides the players already in it, as no other non-invasive imaging modality is able to provide comparative results as quickly, safely and easily to patients. However, generic contrast media manufacturers may acquire market share if they are able develop a reputable brand provided at a lower cost than the four leading market players: GE Healthcare, Bayer, Bracco and Guerbet.

Sanghera added, “Due to excellent safety profiles, image enhancement and wide indication coverage, contrast media have become a mainstay of modern medicine. Nuclear medicine could be a competitor in the future, but for now the contrast media market is in a stable position.”

For more information: www.globaldata.com

August 17, 2023

August 17, 2023