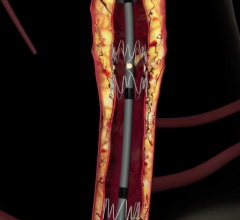

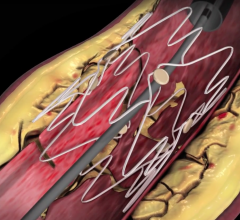

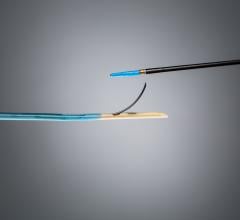

December 7, 2007 - Edwards Lifesciences Corp. today has entered into a definitive agreement to sell certain assets related to the Edwards LifeStent peripheral vascular product line to C.R. Bard Inc. for up to $140 million. The transaction is expected to close in January 2008, pending regulatory approvals.

"Although sales are growing, the LifeStent product line is generating operating losses," said Michael A. Mussallem, Edwards Lifesciences' chairman and CEO. "This transaction enables Edwards to increase our investments in the exciting opportunities in our market-leading heart valve and critical care businesses. Achieving leadership in the peripheral vascular market would have required substantial additional investment, which can now be directed to our core businesses."

Under the terms of the agreement, Edwards will receive an initial cash payment of approximately $75 million at closing, plus an additional $65 million in cash upon the achievement of certain milestones, including the receipt of U.S. regulatory approval of Edwards' LifeStent products for a superficial femoral artery indication and the transfer of LifeStent device manufacturing. For 2007, this business represents approximately $30 million in sales.

Edwards will provide transition services for a period of up to two and a half years following the closing. Approximately 150 employees may be affected by the end of the transition.

"We would like to express our sincere gratitude to our dedicated employees along with the committed clinicians in this field with whom we have had the opportunity to work over the past several years. We clearly recognize the value that has been created as a result of their efforts to improve the care of patients suffering from peripheral vascular disease," said Mussallem. "We are pleased that patients will continue to benefit from this technology under the new ownership."

For more information: www.edwards.com

November 06, 2019

November 06, 2019