November 1, 2012 — It looks as though drug-eluting balloons (DEBs), already widely used in Europe, are set to burst into the global market as heart conditions become a more common problem, states a new report by healthcare experts GBI Research.

The new report looks at peripheral vascular disease (PVD), which involves the buildup of plaque, the subsequent narrowing or blockages in arteries, and insufficient blood flow. The growth of the peripheral vascular devices market is being driven by rising incidence rates of PVD, due to conditions such as diabetes, end-stage renal disease and obesity becoming more widespread.

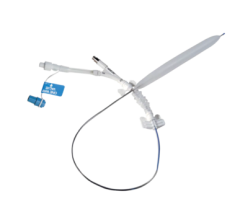

PVD can be treated surgically or via minimally invasive catheter-based techniques. Minimally invasive procedures such as percutaneous transluminal angioplasty (PTA) and endovascular aneurysm repair (EVAR) to treat abdominal aortic aneurysms (AAAs) and thoracic aortic aneurysms (TAAs) have become widely adopted, due to improved patient comfort, faster recovery and lower morbidity rates. A broad trend is seeing many patients opt for less invasive procedures over traditional open surgery, driving demand for devices used in these procedures, such as PTA peripheral DEBs, peripheral vascular stents, stent grafts and PTA balloons.

The high risk of stent thrombosis means that patients who undergo vascular surgery are often prescribed antiplatelet therapy to prevent clot formation. However, this is unsuitable for elderly patients, pregnant women and individuals at high risk of bleeding. Luckily, DEBs require a shorter regimen of antiplatelet therapy than other treatment options, requiring only three months of therapy, rather than the standard 12 months required for drug-eluting stents (DESs), due to the lower associated risk of thrombosis. DEBs are also able to overcome the various issues associated with stents, such as high risk of restenosis, incomplete drug delivery and limited area coverage for drug delivery, which has increased the demand for DEBs around the world.

While DEBs are accepted by most physicians in Europe, they are yet to be approved in the United States, Canada and Japan. These countries offer strong opportunities for market growth if companies can successfully expand there.

For more information: www.gbiresearch.com

June 13, 2024

June 13, 2024