August 17, 2009 – The single largest factor for growth in the remote/home patient monitoring market is in cardiovascular disease (CD) in the United States, according to a new report from the healthcare market research firm Frost & Sullivan.

The trend is partially driven by the implementation of successful payment strategies and directly correlates to cardiac monitoring devices such as blood pressure monitors and will continue to boost ambulatory and home sales directly, along with growth seen in the hospital setting.

Frost & Sullivan’s “North American Home Health Care and Disease Management Markets for Remote Patient Monitoring,” finds this market earned revenues of more than $98.2 million in 2008 and estimates this to reach $428.6 million in 2015.

"Recent years have witnessed a revolution in the healthcare segment with the focus intensifying on preventative healthcare, and self monitoring is an important facet of preventative health," says Frost & Sullivan Industry Analyst Zachary Bujnoch. "Easy-to-use informative devices, including blood pressure monitors, will benefit from this long-term change."

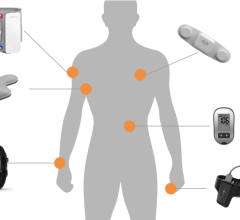

As the number of patients afflicted with CD, diabetes, asthma, obesity, and other conditions increase, healthcare providers rely heavily on remote patient monitoring. In response, technology advances at a rapid pace in the home and healthcare and disease management market segments. Adopting the trial-and-error method, market participants become increasingly adept at providing quality products and services. Participants also portray their services in a better light by unleashing competitive strategies. To promote customer satisfaction, vendors will continue to leverage advancements in technology to establish a firm foothold in this domain, Frost & Sullivan said.

The lack of policy support in the form of direct reimbursement severely reigns in this promising market; without the guarantee of direct reimbursement, the cost saving capability of these services remains questionable.

"At present, it seems very unlikely that any significant progress will be made toward direct reimbursement in the next two to five years," observes Bujnoch. "As a result, market participants are forced to seek alternative payment strategies, and while some of these have proved successful, the huge billion dollar market potential this space possesses is unlikely to be reached without some form of direct reimbursement."

Innovative payment strategies adopted for the time being include pay for performance methods, episode care models, and grants in the form of individual state Medicaid sponsored programs.

Competition in this market expects to intensify greatly over the next couple of years, and this will increase the focus on price as a competitive factor. While the home healthcare and disease management market consists primarily of small companies, the entry of large participants with diverse capabilities and ample financial resources will exert intense pressure on smaller participants.

For more information: www.patientmonitoring.frost.com, www.frost.com

September 16, 2025

September 16, 2025