Boston Scientific's Taxus DES currently holds 55 percent of the market.

As new drug-eluting stents (DES) receive premarket approval (PMA) from the FDA, despite an abrupt downturn in the market, competition among platforms is expected to heat up. DES use will be further bolstered by positive reports on percutaneous coronary implant (PCI) procedures from the ARRIVE, SPIRIT II, COURAGE and CREATE clinical trials.

But do these new developments mean that concerns over late-stent thrombosis have been forgotten? Or will looming doubts stagger renewed adoption of DES in the clinical setting?

DES Market Swings

“I think the most important thing in the last year is that we’ve seen a real stabilization as to where DES utilization is going. After a high of 90 percent use a few years ago and a decline to 62 percent after the concerns of late-stent thrombosis, we’ve seen that the numbers have stabilized to a significant extent. And, in fact, there maybe a recovery of the DES marketplace over the next year,” said John M. Lasala M.D., Ph.D., professor of medicine, Washington University school of medicine, director, interventional cardiology, cardiac catheterization laboratory, Barnes-Jewish Hospital, St. Louis, MO.

Over the last couple of years, emerging reports concerning late-stent thrombosis have caused a pullback in the DES market and a re-emergence of the use of BMS. An FDA-panel finding on Dec. 7-8, 2006, found that DES are as safe as BMS when used in accordance with the product label, but endorsed prior recommendations of the AHA/ACC/SCAI to increase the duration of dual anti-platelet therapy (DAPT) for both approved DES to one year for patients who can tolerate it.

While DES use had reached 90 percent of the total stent market in 2006, over the following year, there was a 35 percent decline in total DES use. The total coronary stent market declined by just under 30 percent and there was a resurgence in bare metal stent (BMS) use. “Coated stents were used in 68 percent of U.S. stent procedures in July, 66 percent in August, and then roughly 62 percent in each month for the rest of 2007,” according to analysts at Millennium Research Group. By the end of 2007, the coated stents’ share of the stent market had bottomed out.

“The market has seen a lot of changes in the recent past,” noted Jeff Mirviss, vice president of marketing for Boston Scientific Cardiology Division. “For all of 2007, [Boston Scientific’s] worldwide sales of DES were $1.79 billion, as compared to $2.36 billion in 2006. U.S. sales of DES were $1.01 billion, as compared to $1.56 billion in 2006.”

The focus for the first half of 2007 was on PCI volume (the number of angioplasties done in the U.S.) as a result of the COURAGE trial presented at the March 2007 ACC meeting. COURAGE raised questions about the relative utility and outcome of patients treated with aggressive medical therapy versus angioplasty. The study compared angioplasty with BMS and medical therapy which was very aggressive (optimal medical therapy). Researchers screened over 30,000 patients to get a small number of patients in the trial for the PCI arm. Within that PCI arm, about one third of the patients had to go from medical therapy to angioplasty because the symptoms were not properly controlled. As a result of that trial, plus information in the media and peer review journals, angioplasties declined 5-10 percent in the subsequent six months.

“We’ve begun to see a leveling out and a return to PCI volume,” said Mirviss. “And, there are many who expect a return to normal growth in 2008; normal being 5 percent year-over-year increases in angioplasties. You can go back over decades and count on 4-6 percent increase year to year in angioplasty volume. So, that’s been fairly regular. Although, it was interrupted by the COURAGE trial.”

The second half of 2007 addressed DES adoption. At the European Society of Cardiology (ESC) and Transcatheter Cardiovascular Therapeutics (TCT) 2007 annual meetings, “there were a series of trials announced that showed DES had similar or a better rate of survival than BMS. And, the hard endpoints showed DES were safe and effective when used according to label indications. When that data came out, the DES adoption started to stabilize. And, there are signs that the market may be growing again,” said Mirviss.

Millennium Research Group is now predicting a turnaround, reporting, “In 2008, we will see the DES market start to rebound. It is not going to go back to the 2006 levels because physicians are being more careful with DES use. It is not necessary to use DES for every patient. Physicians were more enthusiastic about using DES in the past, but they are finding that in some cases bare metal stents work just as well. In 2008, we’ll see an increase in DES with the release of Xience, Endeavor and Promus.”

Good News for Newbies

This new optimism is good news for drug-eluting stents released at the start of 2008 and others awaiting the FDA go-ahead.

While Boston Scientific currently holds 55 percent of the U.S. DES market with Taxus and Johnson and Johnson’s Cypher having the rest, Medtronic’s FDA-approved Endeavor Zotarolimus-eluting stent is now in the running.

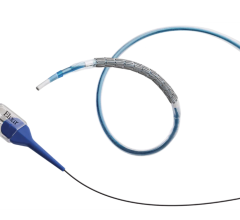

Endeavor was the first new DES approved since 2004 and it is the first in a new generation of drug-eluting stents. The platform combines an advanced cobalt alloy stent with a highly biocompatible polymer coating and a noncytotoxic drug.

Martin B. Leon, M.D., of Columbia University Medical Center and the Cardiovascular Research Foundation in New York, commented on the importance of a next-generation stent reaching the market. “This device addresses an important need by demonstrating comparable clinical effectiveness to a first- generation drug-eluting stent, while also exhibiting a safety profile more typical of a bare-metal stent, long considered a benchmark for safety performance. In addition, it has the advantage of being exceptionally easy to deliver through the tortuous vessels of the coronary vasculature.”

Another highly anticipated DES, the Xience V Everolimus-eluting coronary stent system by Abbott, was recommended for approval by the FDA Advisory Panel on Nov. 29, 2007. According to a recent Bloomberg report, formal FDA approval is anticipated mid-2008. Abbott obtained Xience V when it purchased Guidant Corp.’s stent business for $4.1 billion in April 2006. Boston Scientific is also marketing the same stent, but under the name Promus. Xience V was launched in European and other international markets in late 2006, and in March of 2008, a smaller 2.25-mm stent version received CE Mark approval in Europe and selected countries in Asia and Latin America.

Marketing Makeover

New, favorable data and a new generation of DES are critical for turning the tide and reviving this technology, but much damage has already been done. The tarnished image of these drug-coated stents will not rub off easily, and stent makers must work hard to inform physicians of the facts and win back their trust.

Once Xience and Promus are approved by the FDA, Boston Scientific will have an opportunity and a challenge, promoting its widening portfolio of new DES products.

With both Taxus and Promus in its portfolio, Mirviss said, “We feel we offer a unique advantage to hospitals and physicians, because from one supplier you can have multiple choices. We can put a package together for the hospital in a way that is beneficial.” In addition, the company is hopeful it will gain FDA approval later this year for a small vessel stent, the Taxus Atom, which was studied in the Taxus V trial. “This will be another catalyst to add to market growth. This could be the first DES for small vessels. Right now, patients with small vessels are receiving a bare metal stent, which is associated with higher restenosis rates,” Mirviss said. “So, we hope to offer the broad array of products with the Taxus Liberte (more deliverable), Taxus Atom and Promus. On the Promus side, it’s a very deliverable product with low late loss Everolimus result. Although the data is early, it’s encouraging. So, we feel we have the best of both worlds.”

To address the clinical concerns of late-stent thrombosis, Boston Scientific has developed a multi-faceted approach. The first step was part of an effort to be fully transparent with the data. The company sent out a letter early in 2007 to every interventional cardiologist in the U.S. with the output of the 2006 FDA panel meeting, which found DES as safe as BMS when used in accordance with the product label.

The second phase of the campaign involves market research on the key reasons why patients have late-stent thrombosis. “It appears to be a multi-factorial problem, which requires multifactorial answers. We’ve just launched a new program called Stentplus. It’s a program available to all hospitals free of charge, and it’s aimed at increasing patient compliance with dual anti-platelet therapy. If a patient is not complying with medical therapy, they have an increased risk of stent thrombosis and an increased risk of dying. Knowing this, we’ve launched this multimillion dollar campaign to improve patient education and medication compliance,” he said. “We think that this will help with the problem of late-stent thrombosis.”

Investing in clinical research is the third component. Boston Scientific is a sponsor of the ADAPT study designed to collect and analyze data on late-stent thrombosis. The final component of the campaign is to develop new stent platforms. “These stent platforms will be aimed at increasing the healing in the artery so that it will be faster healing,” said Mirviss. “We will do this with multiple drugs and also fully degradable stents. We have many programs in play to look at speeding up healing and reducing thrombosis.”

What’s on the Horizon?

Just beyond the horizon awaits the latest innovation in stent technology - bioabsorbable stents. Although the bioabsorbable stent market is still at an early stage because these stents are in the early stages of clinical trials, Abbott’s product is at the most advanced stage and may soon be rounding the corner.

“If bioabsorbable stents get to the point where restenosis rates are comparable to DES or BMS, uptake will be rapid. Uptake of bioabsorbable stents will depend on their restenosis rates,” indicated reports from Millennium Research Group.

On March 13, 2008, The Lancet published the first year results of the prospective, non-randomized ABSORB trial. “The world’s first clinical trial of a fully bioabsorbable drug-eluting stent for the treatment of coronary artery disease demonstrated no stent thrombosis, no clinically driven target lesion revascularizations and a low (3.3 percent) rate of major adverse cardiac events (MACE) in 30 patients out to one year.” What is important is Abbott’s bioabsorbable stent “has demonstrated excellent clinical safety out to one year in patients with coronary artery disease,” according to Patrick W. Serruys, M.D., Ph.D., professor of interventional cardiology at the Thoraxcentre, Erasmus University Hospital, Rotterdam, and co-principal investigator in the ABSORB study. “The positive results from this clinical trial form a strong basis for the development of additional bioabsorbable stent platforms with the potential to eliminate some of the restrictions posed by metallic stents in areas such as vessel imaging and vessel remodeling.”

Meanwhile, other companies continue to develop new bioabsorbable stents, stent platforms, stents with smaller diameters, new compounds, alternative antiplatelet therapies and novel assays to measure platelet aggregometry. All of this innovation, combined with clinical expertise and carefully constructed regulatory programs, promises to further advance the science of DES therapy beyond the scope of current practice.

July 02, 2024

July 02, 2024