As payers and other healthcare entities look to better manage costs, especially in the acute care setting, it is important to note that there are some clinical areas where the hospital’s margins are already modest and shrinking. For example, in a typical pulmonary vein isolation case, the cost of devices alone exceeds $10,000. This does not include additional capital equipment costs, software costs, pharmaceuticals, clinical staffing and ancillary equipment or any hospital overhead. Cardiology units are struggling to operate at a marginal profit with shifts in economics due to demographic and technological changes.This is in part due to shrinking Medicare reimbursement and the cost of evolving technologies. In fact, many facilities lose money on electrophysiology (EP) procedures for their growing population of Medicare patients.

Impact of New Technologies on Cost Control Efforts

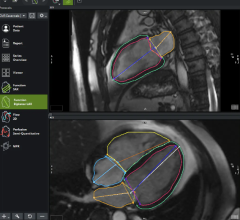

What happens in cardiac catheterization Labs (CCLs) and in EP labs is increasingly important to the healthcare industry overall and to facilities struggling to embrace the triple aim principle of improving care with fewer dollars, all while keeping patients happy. Growth in atrial fibrillation, combined with the increasing costs of procedures to address this demand, has triggered rapid growth in new EP technologies as an alternative to pharmaceutical treatment. For example, EP catheter ablation therapy has advanced treatment of atrial fibrillation, which has driven important gains in patient care. New and more advanced ablation technologies are now being commercialized at a rapid rate, but at the same time these devices have dramatically driven up costs associated with cardiac care.

Are we witnessing the confluence of patient care concerns and technology development as a result of these trends? Rapid response from the industry to increased demand certainly looks like it. However, there is a snag, the interest of the medical device maker, the facility, healthcare and the patient are not always aligned. Of course, when device manufacturers sell more devices or equipment, they benefit. However, when the facility finds ways to reuse devices or reduce the cost of expensive capital equipment while still maintaining quality, the facility and the patient benefit. As an industry, we must seek to balance these interests, adopting new technologies that truly advance treatment, while preserving quality and affordability of care as well as the autonomy of the hospital to make device utilization decisions.

The misalignment can be quantified. Since 2014, the five top device manufacturers in the CCL and EP lab space have more than doubled their stock value (the average growth was 119 percent, although a few tripled their stock value). During the same time period, the top 5 for-profit hospital systems have seen their value cut to 1/3 and negative operating profits are threatening to close the doors of some of the most visited hospitals in the country. American healthcare is profitable if you are a device maker, but challenging, to say the least, if you are a patient or a hospital administrator.

Hospitals are doing all they can. Within the CCL and the EP lab, supply costs are reduced as much as possible. Yet key technologies continue to be adopted as “next-generation devices” and these systems advance the onward and upward cost spiral and consume any increases in reimbursement. It is important to understand when this adoption is warranted, and when it is, consider ways to preserve revenue through the use of today’s advanced reprocessing capabilities.

Using Reprocessing to Help Preserve Hospital Profitability

Reprocessing of devices can address many of these challenges by better aligning the interests of all parties — manufacturers, hospitals and patients. For decades, the safe and effective reuse of devices has been a key strategy for hospitals to remain profitable despite the rising costs of new technologies. Instead of throwing away thousands of dollars per device, clinicians, especially in the EP lab, have collected these devices and used medical device reprocessors, which are third-party, advanced scientific facilities. As a result, clinicians can safely use these devices two or three more times, and sometimes even more. Every time a used device is re-used, the lab saves thousands on the cost of a new device. Manufacturers still benefit from the revenue of original device sales and in many cases, already own their own reprocessing companies, which drive additional profit. In essence, everyone benefits.

Some EP labs in America have saved more than $1 million per year with this practice, which has been documented to not increase risk or harm to the patient.[1] In an AFib case, where device cost is about $10,000, reprocessing just four devices within a lab brings device cost for the procedure down to about $7,000, a 30 percent savings. This is savings that can make the difference between a financially sustainable EP lab and one that is not.

Unfortunately, the introduction and adoption of some new “locked” devices has limited or eliminated the impact of reprocessing altogether. Today, this effort is culminating in built-in obsolescence of some designs that make reprocessing impossible. Savings of $200,000 – $500,000 per year can be lost, and as a result, facilities will have to cut costs elsewhere. Manufacturers, who are highly profitable, are profiting even more from the same growth in EP and cardiology demand that is making hospitals lose money and reduce their ability to care for patients.

What Hospitals Can do to Retain Reprocessing Dollars

Hospitals must consider the bigger picture in considering whether to adopt new devices that limit reprocessing capabilities. In cardiac cath labs and EP labs, rapid adoption of new technologies is the order of the day, but advancements must be adopted strategically while also determining whether the implied clinical or operational improvement is worth the additional costs. These new devices come with a premium price tag, including irrigated RF ablation catheters sold at an average GPO price of $2,250 per catheter, and the introduction of force-sensing technology brought this price up to about $3,600. Similarly, circular mapping catheters sell for $1,250, but when advanced mapping catheters were introduced, the price went up to $2,000.

It is important to note that most, but not all, new devices represent technical improvements that translate to improved procedure efficacy or patient safety. However, this impact also needs to be considered in the light of a potential financial downside that goes beyond the (increased) price of the device. Specifically, these questions should be asked and researched with the manufacturer:

• Is there clinical evidence of improved performance of device?

• Can the device be reprocessed?

• If not, what functional technical or clinical reason is there that it cannot be reprocessed?

• What is the implication for use of other devices or equipment (do the old cables work, does the software need upgraded, etc.)?

• Are there any long-term commitments made in terms of equipment and consumables surrounding use of the new device?

A Call for Greater Reprocessing Capabilities

At the same time, many devices in cardiology cannot be reprocessed altogether. Because of this, cardiology departments lack the ability to optimize their device investment. These include devices used in atherectomy, balloon therapy, RF ablation, and chronic total occlusion (CTO) procedures. Reprocessing experts believe that manufacturers could and should work to enable reuse in these designs, reducing overall costs for hospitals adopting these technologies.

Device manufactures are now beginning to communicate their intent to be part of the industry’s shift toward value-based care efforts that include cost control measures. Yet reprocessing itself must be part of this intent, as it plays such an important role in the hospital’s efforts to manage their expenses for some of the most high-cost procedures in the cardiology setting. A willingness from manufacturers to invest in developing devices that can be reprocessed would be a valuable and worthy part of this movement.

Reprocessing Should Play a Key Role Within Today’s Value-based Care Efforts

In summary, new technology innovations have dramatically improved quality of care in the cardiology space, but can also come at great cost to the hospital, providers and patients. While there are certainly advancements in medical devices worthy of investment, hospitals and other acute care facilities must carefully weigh all factors including the impact on quality, costs and patient satisfaction while considering adoption of these technologies. Part of that consideration includes seeking transparency about new technology development and the preserving their ability to control medical device investments through reprocessing capabilities. Of course, manufacturers also have a right to make a profit from the sale of innovative devices. By aligning the needs of all these stakeholders, our industry can truly make progress in controlling costs without sacrificing patient health outcomes.

Editor’s note: Lars Thording is a marketing and communications strategist with a history of achievements in market disruption in healthcare and related industries. Originally from Denmark, he initially pursued a career in academia and he had the opportunity to teach at universities in Denmark, Ireland and the United States. After a few years as a strategic branding consultant in pharma/biotech, Lars served in executive roles with various companies, including the company that pioneered medical device reprocessing. Lars is currently serving as vice president of marketing and public affairs at Innovative Health. Lars holds undergraduate degrees in marketing and in educational sociology, an MA in international commerce as well as a Ph.D. in international marketing from the University of Southern Denmark.

Related Content:

Integrating Cath and EP Lab Reprocessing With OM Technology Development

Reference:

November 14, 2025

November 14, 2025