Peripheral Vascular Market Expected to See Strong Market Growth

January 28, 2013 — According to Millennium Research Group (MRG), increasing awareness and diagnosis of peripheral vascular disease (PVD) along with the introduction of improved next-generation devices will lead the United States peripheral vascular (PV) device market to grow strongly to reach $3.3 billion by 2017.

Lower extremity treatment will grow substantially, as physicians and device manufacturers continue to focus on the prevention of limb amputation. A variety of recent and upcoming device launches, including drug eluting stents (DES) and drug-coated balloons (DCB), as well as improvements in lower-extremity stents will provide physicians with more options for treating lower extremity peripheral artery disease (PAD).

Growth in the femoral-popliteal (fem-pop) indication will be particularly strong. Historically, concerns about stent fractures have restrained their use, but next-generation devices offer improved flexibility and strength to address this issue. For example, Covidien recently released its Protege EverFlex and Flexible Stenting Solutions released its FlexStent, while IDEV Technologies is anticipated to receive U.S. Food and Drug Administration (FDA) approval for use of the Supera Veritas stent in the fem-pop arteries before 2015.

Furthermore, continued adoption of and physician familiarity with chronic total occlusion (CTO) devices will allow for endovascular treatment of increasingly challenging lesions in these indications, driving overall procedure volumes. In addition to the large players, including Boston Scientific, C. R. Bard, Cordis, Covidien and Medtronic, this segment has attracted a number of niche competitors such as Avinger, Baylis Medical and Spectranetics; these companies will be likely acquisition targets for larger competitors looking to expand their lower-extremity PV offerings.

"Aortic stent grafts will be the strongest growing peripheral vascular device segment, spurred by continual device improvement efforts by manufacturers," said MRG Analyst Louise Murphy. "A number of new manufacturers have begun to enter the U.S. market, based on its favorable climate and the need for niche devices and innovations."

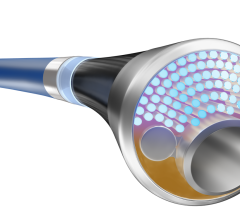

Smaller new competitors in the abdominal aortic stent graft segment include Endologix, Aptus Endosystems and TriVascular, with Lombard Medical and Bolton Medical expected to enter the market before 2017. Device innovations such as fenestrated grafts, low-profile devices and improved fixation mechanisms will help differentiate competitors and drive market growth.

MRG’s U.S. Markets for Peripheral Vascular Devices report includes unit, average selling price and revenue information, along with market drivers and limiters and competitive landscape for peripheral vascular (PV) stents, percutaneous transluminal angioplasty (PTA) balloon catheters, chronic total occlusion (CTO) crossing devices, embolic protection devices (EPD), aortic stent grafts, synthetic surgical grafts, and PV accessory devices sold in the United States.

For more information: www.MRG.net, www.DecisionResourcesGroup.com

September 12, 2025

September 12, 2025