December 26, 2013 — A report released by IMV Medical Information Division found that providers of nuclear medicine (NM) services are consolidating as procedure volume dropped in the subspecialty from 2008 to 2012.

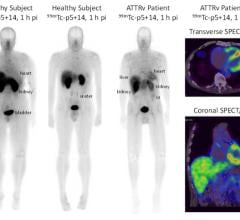

An estimated 14.5 million nuclear medicine patient studies were performed on 14,825 single-photon emission computed tomography (SPECT) or SPECT/CT in the United States in 2012. Compared with the 16 million patient studies performed in 2008, total nuclear medicine patient studies have decreased about 9 percent, for an average annual decline of 2.5 percent per year from 2008 to 2012.

“We attribute this decline in NM patient studies to several factors, including the impact of precertification requirements from health insurance companies, reduced reimbursement and studies shifting to competing technologies, such as bone studies shifting to PET,” said Lorna Young, senior director of market research, IMV.

IMV’s study also shows that physician practice locations (primarily cardiology practices) are feeling financial pressure due to reduced reimbursement from Medicare and third-party payors. When asked about the issues affecting their future outlook, both hospitals and non-hospitals responded that “reductions in Medicare and third-party reimbursements are causing NM revenue to decline” is their top-rated issue, but managers of physician practices are more likely to rate this as a top issue than are administrators of hospital nuclear medicine departments.

Due to these pressures, the number of physician practices performing nuclear medicine studies has declined 6 percent over the past two years, and this decline is likely to continue.

Respondents from physician office locations were asked if they were planning to pursue certain strategic actions over the next few years, including changing their practice ownership structure to include a joint venture with hospitals. Almost one-third of the respondents are either considering or planning such a change in their practice model.

This in turn is impacting their purchase plans for nuclear medicine cameras. While 29 percent of the nuclear imaging sites in the survey are independent physician office locations, less than 10 percent of the sites planning camera purchases through 2015 will be physician offices.

According to the report, while the nuclear medicine market is currently slowing down with the decline in patient studies and a reduction in the number of sites performing NM studies, there is a relatively large installed base of aging equipment. Of the sites that are planning to purchase NM cameras, almost 90 percent of the planned purchases will be for replacement units.

Based on market scenarios for unit sales from 2013 to 2017 provided in the report, IMV anticipates that the years 2015-2017 will be relatively active years for system replacements. One driver for replacement activity is the SPECT/CT camera, which will comprise at least 40 percent of the planned purchases for nuclear medicine cameras.

IMV’s 2013 Nuclear Medicine Market Outlook Report describes trends in nuclear medicine patient volume by study type, radiopharmaceutical and pharmacological stress agent utilization, SPECT versus SPECT/CT camera installed base and purchase plans, site operations characteristics and department managers' opinions about the factors affecting the future outlook for nuclear medicine.

In the report, IMV also provided market scenarios for nuclear medicine camera purchases from 2013 through 2017. Vendors covered in this report include Cardinal Health, Digirad, GE, Philips, Siemens, Spectrum Dynamics and Triad.

Additional highlights include:

- A larger 80 percent proportion of the NM studies conducted in nonhospital locations are cardiovascular studies, compared with 46 percent of those conducted in hospitals. Hospitals are more likely to be conducting other procedure types, including bone scans, liver/hepatobiliary, renal, respiratory, infection/abscess and tumor localization studies.

- An estimated 8 million myocardial ischemia perfusion studies were performed in 2012, of which 58 percent used pharmacological stress agents, either alone or with exercise.

- Just over 25 percent of sites indicated providing neurology applications, and this may grow to more than one-third by 2016.

IMV's 2013 Nuclear Medicine Market Outlook Report is based on the responses to an IMV-hosted online survey from 410 nuclear medicine department/facility managers nationwide. Responses were projected to the universe of 6,985 short-term general hospitals, imaging centers and physician practices in the United States that have fixed nuclear medicine cameras as identified by IMV.

For more information: www.imvinfo.com

June 11, 2024

June 11, 2024