Siemens released the Sensis Vibe hemodyanamics system at ACC.16. The newer system offers better integration of cath lab data into cath lab reports and the electronic medical record (EMR).

There were several trends seen in new cardiovascular technologies showcased on the expo floor at the 2016 American College of Cardiology (ACC) meeting in April. These insights are from clinical analysts from the evidence-based research and consulting company MD Buyline.

Echocardiography

Various levels of ultrasound machines, including portable equipment, continue to be highlighted on the floor of ACC. Vendors showcased more compact, portable systems with a larger number of software features than the previous models. The implementation of speckle tissue tracking (myocardial strain) software seemed to be a focal point for systems, such as Toshiba’s Aplio 500 and the new M9 from Mindray. Vendors vary on the terminology used to describe the tissue tracking software. Although tissue tracking is not a new technological advancement in cardiac imaging, it is now notably simpler to perform an analysis. Strain imaging can be a useful indicator for myocardial function, ventricular dyssynchrony and cardiotoxicity management.

Vendors Respond to Financial Pressures Hospitals Face

Vendors are responding to the financial constraints that healthcare providers face and are providing a wider range of quality equipment that is scalable to meet specific technological, as well as financial, needs. We typically see vendors offer a premium system to meet high-technology applications, such as 3-D/4-D transesophageal echo TEE, while also offering a significantly lower-priced option to meet the daily needs of most healthcare systems with portable requirements. For example, GE was showing the premium Vivid E95 along with the high-end model Vivid S70. Philips also highlighted the premium Epiq 7 platform along with the high-end Affinity platform. Facilities are realizing they can customize the premium-level technology to meet their needs or avoid it all together.

Major vendors in the ECG market now sell multiple systems that are smaller and less sophisticated versions of the premium system. Basic similarities include the analysis algorithm, storage and communications ability. Needs of a busy, urban hospital are not necessarily the same as those of remote sites. Sites can find significant savings through a wise mix of equipment.

Health systems also require integration of their IT and ECG systems to allow full access in electronic medical records (EMR). GE introduced Version 9 of its Muse ECG management system at ACC.16, which allows greater connectivity with other vendors’ ECG systems, including newer, adhesive-based wearable Holter monitors.

Improved Graphic User Interface (GUI) Technology

Vendors are looking to improve customer interface and software for high-complexity technology in order to provide more efficient workflow processes. They are doing so by introducing new technology that significantly simplifies the data capture and data utilization process with a focus on assisting the clinician in key procedural steps. The need to ensure high-quality, complete data capture and reporting is paramount because this will affect reimbursement. Systems are now automatically populating data fields that previously would have needed to be entered manually. The technology also is cross-checking the values to verify they are falling within acceptable values and ensure the data points are legitimate.

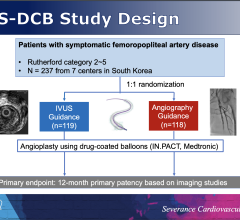

Hemodynamic monitoring technology vendors showing these improvements include GE Healthcare (Mac-Lab), Philips Medical (Xper Flex Cardio) and Siemens (Sensis Vibe). All three vendors have changed and enhanced their solutions to be less labor intensive and to capture the critical values. This ensures a complete record is captured for accurate diagnosis and complete reimbursement without delays due to missing or incorrect data. We believe this is an important and necessary step because reimbursement is now tied to complete and accurate documentation. Additionally, there is a need to minimize the potential for human error, which can negatively affect the procedure information and the associated reimbursement.

Security Concerns Bring Customizable Options to Providers

Vendors in the cardiology market are reacting to market needs for improved protection from security breaches by providing strong security options for equipment, software and management systems. According to vendors, this is driven in part by large IDNs and the government. Current security options offered allow an individual facility or organization to review and choose what degree of security to implement. This is important because strong security may significantly affect workflow and productivity. Allowing for customizations helps providers make a manageable and realistic compromise between security needs and the daily workflow and patient care.

IT Involvement Growing in Clinical Decisions

As the push for integration in healthcare continues to grow, we are seeing information technology (IT) personnel become more involved in the decision-making process of new and, in some cases, existing technology. Additionally, healthcare provider organizations, which have grown through partnerships, mergers and acquisitions, are looking to begin a process of transitioning these larger systems onto the same or similar vendors for IT software and infrastructure, as well as medical technology.

The need for healthcare providers, from individual physicians to large healthcare systems, to move to an electronic health record (EHR) solution also has pulled IT further into the clinical decision making process. This has led to new challenges not only for customers, but also for vendors who are being asked for solutions that work with a range of technology that can vary widely with regard to functionality, consistency and open vs. closed architecture. When vendors with clinical solutions must coordinate and work with large, well-established IT/EMR vendors in their respective markets, the two areas that seem to create particular challenges are integrating/interfacing EHRs with clinical monitoring and/or imaging. At the ACC.16, numerous discussions with multiple clinical vendors touched on challenging experiences trying to work with major lT vendors. It was particularly challenging with EHR vendors that have a sizable market share.

Hospitals need coordination with vendors to achieve the goal of a well-designed, integrated system that allows the hospital to record, capture and use a wide range of disparate data that makes up the complex, clinical picture of medical findings, diagnosis and treatment or therapy solutions. Although IT vendors are adept at capturing and using data, there is a disconnect when it comes to working with the corresponding “experts” on the healthcare side. Multiple vendors described such situations during our discussions at ACC.

The challenging issue is a concern for customers who are being asked to require their medical vendor(s) work with an IT vendor. There can be significant hurdles and roadblocks that both sides must work to remove. Key information and data collected as part of the medical procedure, evaluation, diagnosis or therapy may not be compatible or captured by the EMR. Customers sometimes need to maintain two systems with limited connectivity in order to have a truly complete clinical record that might be achievable in one system with a true sense of cooperation between the medical vendor and the IT vendor.

Editor’s note: Authors Jon Brubaker, MBA, RCVT, Tom Watson, BS, RCVT, and Sabrina Newell MS, RCS, are clinical analysts from the evidence-based research and consulting company MD Buyline. It provides hospitals and healthcare systems information to help make sound financial decisions for purchased services, capital equipment and technology, and consumables.

July 31, 2024

July 31, 2024