May 16, 2014 — In a move to expand significantly its portfolio of solutions for peripheral interventions, Boston Scientific Corp. has entered into a definitive agreement to acquire the interventional division of Bayer AG for $415 million in cash, including fees for transitional services. The company expects to close the transaction in the second half of 2014, subject to customary closing conditions.

The addition of Bayer Interventional's commercial organization and technologies supports Boston Scientific's strategy to provide a comprehensive portfolio of solutions to treat peripheral vascular disease. The acquisition is expected to improve Boston Scientific's access to a number of attractive segments in the peripheral space, including the growing atherectomy and thrombectomy categories. In 2013, Bayer Interventional generated sales of approximately $120 million.

"We expect this acquisition will help fuel continued growth for the company and we are looking forward to welcoming the team from Bayer Interventional to Boston Scientific," said Mike Mahoney, president and CEO, Boston Scientific. "These technologies help physicians save both limbs and lives, and we believe this transaction will enable us to reach more effectively the greater than 27 million patients worldwide who suffer from the debilitating effects of peripheral vascular disease."

Upon completion of the transaction, Bayer Interventional will become part of the existing Boston Scientific Peripheral Interventions business.

"The addition of Bayer Interventional will expand our commercial footprint and enhance our ability to provide physicians and healthcare systems with a complete portfolio of solutions to treat challenging vascular conditions," said Jeff Mirviss, president, Peripheral Interventions, Boston Scientific. "We believe this acquisition will accelerate the growth of our Peripheral Interventions business and strengthen our position as a global leader in peripheral therapies."

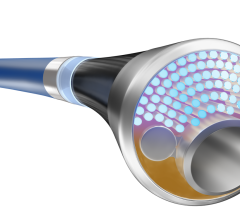

Based near Minneapolis, Bayer Interventional has approximately 350 employees and offers a number of technologies designed to treat coronary and peripheral vascular disease. The transaction includes the AngioJet thrombectomy system and the Fetch2 aspiration catheter, which use endovascular techniques to remove blood clots from blocked arteries and veins, and the JetStream atherectomy system, a minimally invasive device used to remove plaque from diseased peripheral arteries.

"We are confident that the planned sale of AngioJet, Jetstream and Fetch2 is a positive step for the long-term sustainability of these products, given Boston Scientific's strong position in devices for peripheral and cardiovascular diseases," added Alan Main, president of Bayer HealthCare's Medical Care Division and member of the Bayer HealthCare Executive Committee.

The agreement calls for an up-front payment of $415 million. The company currently expects the transaction to be immaterial to adjusted earnings per share in 2014, accretive by approximately $0.01 in 2015 and increasingly accretive thereafter. On a GAAP earnings per share basis, the company expects the transaction to be slightly dilutive in 2014, immaterial in 2015 and less accretive than on an adjusted earnings per share basis thereafter as a result of acquisition-related net charges and amortization, which will be determined following the closing. Closing of the transaction is subject to customary conditions, including relevant antitrust clearance, and is expected to occur in the second half of 2014.

For more information: www.bostonscientific.com

September 12, 2025

September 12, 2025