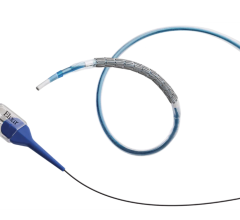

Boston Scientifics TAXUS Liberte paclitaxel-eluting coronary stent.

Over the past year several new drug-eluting stents (DES) stents have been released and SYNTAX trial data proved DES compare as well as coronary artery bypass graft surgery (CABG) in patient outcomes.

DES vs. CABG

In January Boston Scientific reported encouraging one-year data from its SYNTAX, the first trial to compared percutaneous coronary intervention (PCI) using the TAXUS Express2 paclitaxel-eluting stent to CABG in patients with the most complex coronary artery disease. The 1,800 patient study showed no overall statistically significant differences between PCI and CABG in rates of death or myocardial infarction, although PCI patients were more likely to require a repeat revascularization.

The rate of stroke was lower for PCI, 0.6 percent, as compared to 2.2 percent for CABG. Overall 12-month MACE (all-cause death, stroke, MI and repeat revascularization) was higher for PCI (17.8 percent versus 12.4 percent) due to more repeat revascularization in the PCI arm (13.5 percent versus 5.9 percent). Most repeat revascularizations in the PCI arm were performed by additional PCI, with only 2.8 percent of PCI patients ultimately requiring CABG, researchers said.

Fifteen-month data was released this summer from the SYNTAX-LE MANS substudy, which separately evaluated PCI and CABG in patients with left main disease. Of the TAXUS patients, 92 percent showed long-term patency (less than 50 percent stenosis). The MACE rate was 13, and resulted in a 9 percent rate of repeat revascularization.

For CABG the primary endpoint was a ratio of 50 percent of less occlusion of the grafts (?50 percent) to total grafts placed. The result was 16 percent (27 percent on a per-patient basis), with 10 percent totally occluded. The MACCE rate of 9 percent was not significantly associated with graft obstruction/occlusion.

One of the key aids for cardiologists coming out the study is the development of the SYNTAX Score, which provides an objective means to risk-stratify patients for either PCI or CABG. It characterizes coronary anatomy based on lesion frequency, complexity and location, and assigns a score to each patient. Higher scores mean a patient has more complex disease and treatment challenges, meaning CABG may be the best option. The score details can be found at www.syntaxscore.com.

New Developments in DES

Abbott – In July 2008 Abbott launched its XIENCE V in the U.S. and has several other DES in development. Its next generation DES is the XIENCE PRIME everolimus-eluting coronary stent, which gained European CE mark in June. The new stent features very thin struts and is designed for easier delivery.

“One of the biggest things we keep hearing is that physicians want more deliverable stents,” said Chuck Simonton, M.D., Abbott Vascular’s chief medical officer and division vice president of medical science.

He said the PRIME is currently in FDA trials and the company hopes it may gain FDA clearance sometime in 2011 and 2012. The company is currently launching the stent in Europe in a range of sizes, with lengths up to 38 mm. The longer lengths match those offered by Boston Scientific’s TAXUS Liberte Long, which was released in Europe in 2007 and received FDA clearnce this summer.

Dr. Simonton said the bare metal stent version of PRIME, the MULTI-LINK 8 (ML8), will begin trials at the end of 2010 or early 2011. He said the company also plans to release the XIENCE PRIME SV, a 2.25 mm stent for small vessels, and XIENCE PRIME LL for long lesions.

There are discussions of releasing a version of the PRIME with a bioabsorbable polymer containing everolimus. However, Dr. Simonton said PRIME uses the same polymer system as the XIENCE, which has a very low rate of stent-thrombosis at about 3 percent, so it may not be worth the cost to develop a bioabsorbable polymer and put through trials. Instead, he said Abbott is putting a lot of resources into developing the BVS totally-bioabsorbable DES stent, which is currently in European clinical trials.

Abbott is also in U.S. trials with the XIENCE Nano, a 2.25 mm DES designed for small vessels. Dr. Simonton said the FDA trial registry is currently enrolling patients, which should be completed by the end of 2009. The stent received CE mark in Europe in March 2008, where it is called the XIENCE V 2.25 mm stent system.

Boston Scientific – The rapid release of several new stents over the past year, combined with its SYNTAX trial, earned Boston Scientific the 2008 North American Frost & Sullivan Market Leadership Award.

In the past year Boston Scientific has released the PROMUS Everolimus-Eluting Coronary Stent System, the TAXUS Express2 Atom Stent, TAXUS Liberte, TAXUS Liberte Atom, and the TAXUS Liberte Long.

The TAXUS Express2 Atom, cleared by the FDA in September 2008, and the TAXUS Liberte Atom, cleared in June 2009, are first DES approved for the treatment of small coronary vessels down to sizes of 2.25 mm. The TAXUS Liberte Long was approved in July and is longest coronary stent available in the U.S., up to 38 mm in length.

For its next generation DES, Boston Scientific is concentrating on its JACTAX stent, which uses the Labcoat bioabsorbable polymer.

Medtronic – The company’s focus is on its zotarolimus-eluting Endeavor and new Resolute stent, which has a longer drug elution time. Medtronic will launch Resolute internationally at TCT 2009, but it is not FDA-cleared. Resolute uses the same zotarolimus and stent platform as Endeavor, but uses Medtronic’s new BioLinx blend of three polymers, which is specifically formulated for better biocompatibility and longer drug elution than Endeavor (six months as opposed to two to three weeks).

The company is in its first year of the 2,300-patient RESOLUTE All-Comers clinical trial in Europe. The randomized trial compares the safety and efficacy of Resolute with Abbott’s XIENCE. Medtronic is now enrolling in its U.S. trial of 1,300 patients, which will be used for its FDA submission. FDA approval may possibly come in 2012, said Cy Wilcox, Medtronic Cardiovascular’s vice president of science and technology.

“We know after the first year patients do very well and the target lesion revascularization (TLR) rate is very low,” Wilcox said.

He said the company believes the low TLR is due to Medtronic’s polymers being more biocompatible and hydrophilic than other manufacturers. Wilcox said this makes Medtronic’s stents easier to deliver and result in lower rates of late-stent thrombosis. “Our research suggests it’s their polymers that are the problem,” he said of other manufacturers.

Wilcox said Medtronic is developing a polymer-free DES that uses a micro-porous stent surface – technology the company licensed from NanoMed Systems. However, he said without a polymer base, the drug elutes very quickly, within one to three weeks.

Medtronic is also working on a next generation bare metal stent that will be similar to the Driver, but made of a single piece of wire. Wilcox said the Drive uses a series of rings and longer connecting arms, which may cause friction against vessel walls, but the new stent’s single wire design will make pushability about 30 percent easier, according to bench tests. He said Medtronic is also thinking about putting a DES coating on the new stent.

Cordis – The company is concentrating efforts on its NEVO stent currently in clinical trials. The stent uses a bioabsorbable polymer loaded into tiny holes along the stent struts. Cordis hopes to file for CE mark by the end of 2009 and plans to submit for FDA approval by the end of 2011.

For More Information:

www.cypherstent.com

www.endeavorstent.com

www.syntaxscore.com

www.stent.com

www.taxus-stent.com

www.xiencev.com

July 02, 2024

July 02, 2024