April 28, 2016 — Abbott and St. Jude Medical Inc. announced a definitive agreement for Abbott to acquire St. Jude Medical. The merger will create a premier medical device leader with top positions in high-growth cardiovascular markets, including atrial fibrillation, structural heart and heart failure as well as a leading position in the high-growth neuromodulation market. St. Jude Medical's strong positions in heart failure devices, atrial fibrillation and cardiac rhythm management complement Abbott's leading positions in coronary intervention and transcatheter mitral repair.

With combined annual sales of approximately $8.7 billion, Abbott's cardiovascular business and St. Jude Medical will hold the No. 1 or 2 positions across large and high-growth cardiovascular device markets and will compete in nearly every area of the market — with an aggregate market opportunity of $30 billion.

"Bringing together these two great companies will create a premier medical device business and immediately advance Abbott's strategic and competitive position," said Miles D. White, chairman and chief executive officer, Abbott. "The combined business will have a powerful pipeline ready to deliver next-generation medical technologies and offer improved efficiencies for health care systems around the world."

"Today's announcement is an exciting next chapter for St. Jude Medical, bringing together two industry leaders with a shared passion for innovation, culture and patients," said Michael T. Rousseau, St. Jude Medical president and chief executive officer. "Our combined scale will expand the global reach, competitiveness and impact of our medical device innovation for physicians and hospitals. This transaction provides our shareholders with immediate value and the opportunity to participate in the significant upside potential of the combined organization. I'd like to thank our 18,000 employees whose hard work and commitment help us deliver leading medical technologies to patients around the world."

Financial Details

The transaction, which has been approved by the boards of directors of St. Jude Medical and Abbott, is subject to the approval of St. Jude Medical shareholders and the satisfaction of customary closing conditions, including specified regulatory approvals. The transaction is expected to close in the fourth quarter of 2016.

Under the agreement, St. Jude Medical shareholders will receive $46.75 in cash and 0.8708 shares of Abbott common stock, representing total consideration of approximately $85 per share. At an Abbott stock price of $43.93, this represents a total transaction equity value of $25 billion.

The acquisition of St. Jude Medical is expected to be accretive to Abbott's adjusted earnings per share in the first full year after closing and increasing thereafter, with approximately 21 cents of accretion in 2017 and 29 cents in 2018. Abbott said the combination is anticipated to result in annual pre-tax synergies of $500 million by 2020, including both sales and operational benefits. One-time deal-related costs and integration costs will be provided at a future date.

St. Jude Medical's net debt of approximately $5.7 billion will be assumed or refinanced by Abbott. Abbott said it intends to fund the cash portion of this transaction with medium- and long-term debt.

History of Partnership

Since 2008, Abbott and St. Jude Medical have been in a sales alliance that provides mutual U.S. customers access to both companies’ portfolios of interventional cardiology, cardiac rhythm management, EP and intravascular imaging and diagnostic technologies. The companies renewed and enhanced that alliance in 2012, where both companies agreed to jointly promote each other's product offerings when developing contract solutions with hospital customers in the United States. A separate distribution agreement between the two companies granted Abbott the rights to distribute the St. Jude Medical Ilumien PCI Optimization System, the only integrated FFR and OCT platform in the United States.

Abbott Has Several Recent Acquisitions

St. Jude Medical is the largest of several corporate acquisitions in recent years to expand Abbott’s cardiovascular portfolio.

Last August, to expand its structural heart offerings, Abbott entered into an agreement to purchase Tendyne Holdings Inc. for $250 million. The company is developing minimally invasive mitral valve replacement therapies. In a separate transaction, Abbott provided capital and secured an option to purchase Cephea Valve Technologies. Cephea is developing a catheter-based mitral valve replacement therapy. Financial terms were not disclosed.

To expand its EP technology, in February Abbott acquired Kalila Medical Inc., which developed a novel steerable sheath that helps physicians more easily access and perform catheter-based electrophysiology procedures. In 2014, Abbott purchased Topera Inc., which had developed a atrial fibrillation rotor mapping system to improve AF diagnosis and treatment.

Abbott purchased Alere Inc. in February for $5.8 billion. Alere offers the handheld, point-of-care Triage MeterPro testing system, which is similar to Abbott’s i-STAT system. The MeterPro can measure, among other things, troponin level in cardiac patients. Once the transaction is completed, Abbott's total diagnostics sales is expected to exceed $7 billion after the close.

To expand its peripheral artery disease (PAD) portfolio, in 2013 Abbott purchased IDEV Technologies for $310 million. IDEV Technologies' products include Supera Veritas, a self-expanding nitinol stent system.

Key Technologies

Both companies offer new state-of-the-art medical technologies. St. Jude Medical offers a complete electrophysiology (EP) portfolio with electromapping systems, transcatheter ablation systems, pacemakers, implantable cardioverter defibrillators (ICDs), implantable cardiac resynchronization therapy (CRT) devices, and the CardioMEMS implantable heart failure monitor. The company has a catheter-based implantable pacemaker in development to eliminate the need for leads and surgical implant. In the cath lab, St. Jude’s portfolio includes fractional flow reserve (FFR) catheter-based hemodynamic flow quantification and optical coherence tomography (OCT) intravascular imaging. The company recently purchased ventricular assist device (VAD) maker Thoratec, which is developing the Percutaneous Heart Pump, a catheter-based temporary hemodynamic support device.

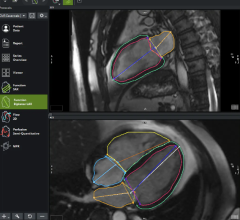

St. Jude’s EnSite Precision next-generation EP cardiac mapping system is used to visualize and navigate catheters in the heart during ablation procedures. Its first-to-market MultiPoint Pacing technology advances quadripolar technology and provides additional options for cardiac resynchronization therapy patients who are not responsive to other pacing options. The St. Jude Proclaim Elite recharge-free Spinal Cord Stimulation System and Prodigy Chronic Pain System are used for treating chronic pain and are MRI safe, upgradeable.

Abbott is a leader in interventional cardiology, offering the market leading Xience V drug-eluting stent and an array of tools for access, catheter guidance and vascular closure. The Absorb stent is the first bioresorbable stent to face U.S. Food and Drug Administration (FDA) review, with a final decision possible later in 2016. The Abbott MitraClip is the first and only transcatheter mitral valve repair system approved in the United States.

For more information: www.abbott.com

November 14, 2025

November 14, 2025